26+ Free Printable Direct Deposit Form Templates

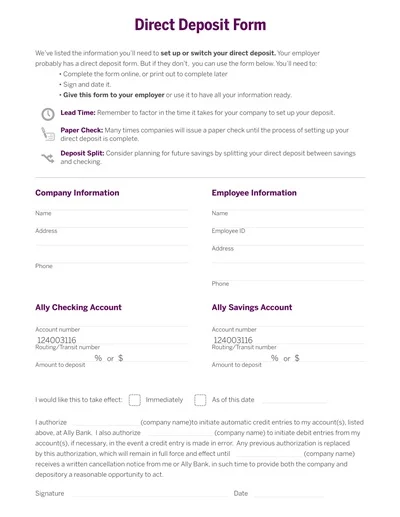

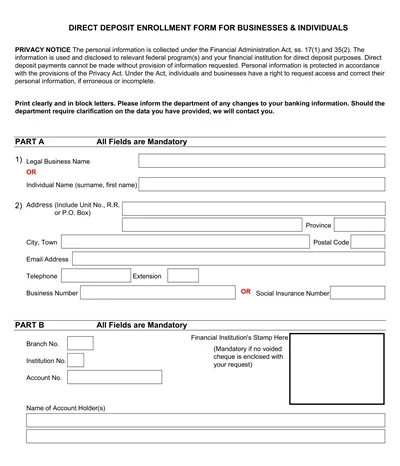

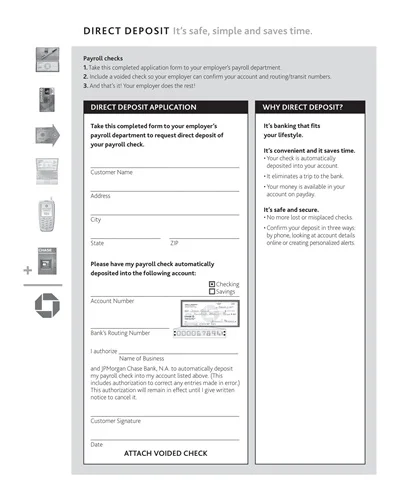

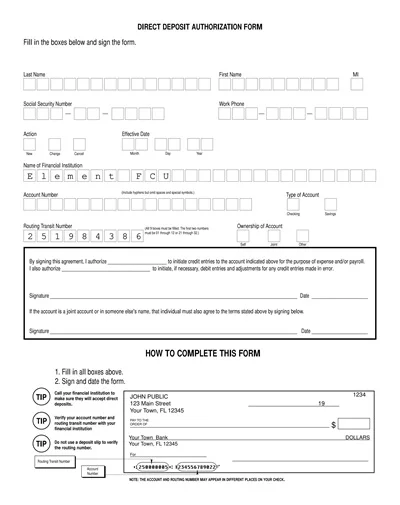

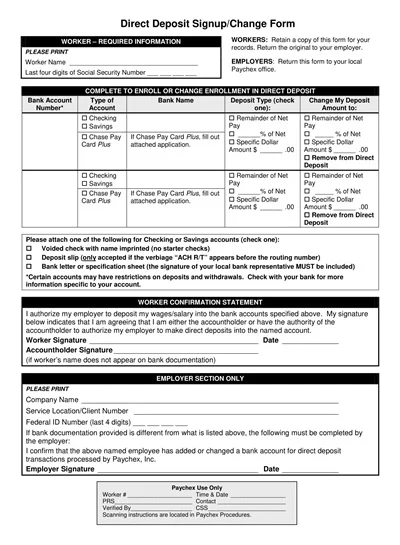

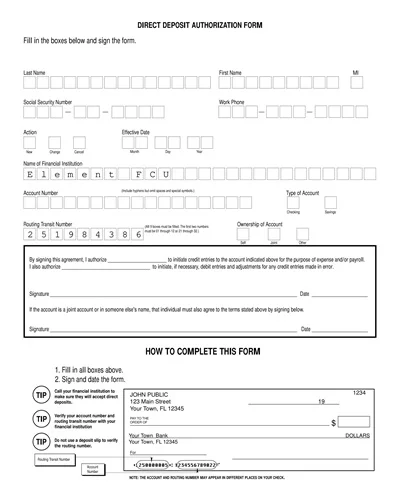

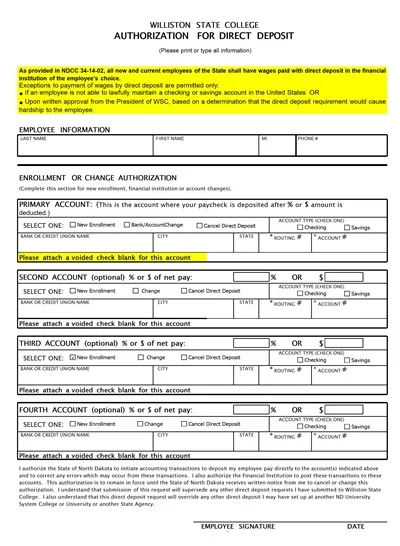

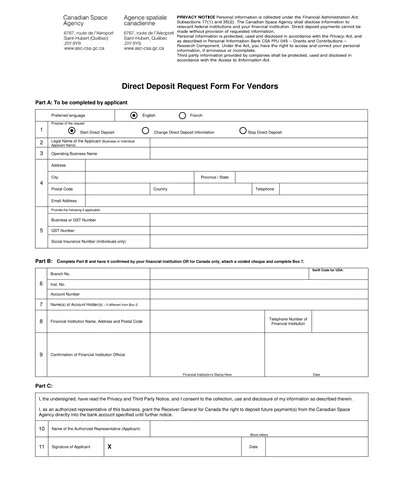

A Direct Deposit Form Template is a form that a particular individual fills with data to give an employer or company permission to deposit money into their bank account. Oftentimes, this template will also contain key fields, such as a person’s name, bank account number, routing number, type of account either checking or saving, and the name of the bank.

Table of Contents

The direct deposit form template allows organizations to automate the process of payment transactions, resulting in a reduction of errors and an increase in proficiency. This method not only enables the financial institutions to quickly deposit the cheques, but it also helps to minimize the risks of handling physical cheques.

Download Free Printable Direct Deposit Form Templates

What is a Direct Deposit Form?

Direct Deposit Form is a document through which a person authorizes the employer, bank, or any other entity to deposit the individual’s money directly into the person’s bank account. The type often asks for personal data such as the name of the owner, the name of the bank, the bank routing number, and the account number.

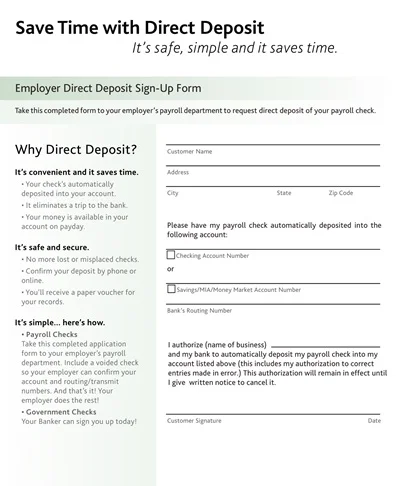

Direct deposit is a very convenient and secure way of receiving payments and with this kind of delivery, the funds are transferred without the need for physical checks. It simplifies the payment process, minimizes lost or stolen checks probability, and sometimes provides a chance to get the funds instantly.

Types of Direct Deposit Form

There are multiple types of direct deposit forms, each having a distinct role and adhering to different needs.

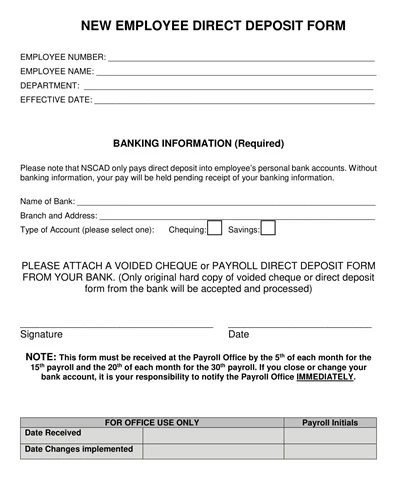

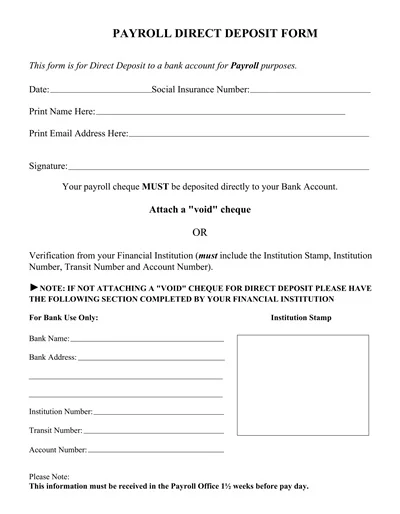

1. Employee Payroll Direct Deposit Form

This mechanism is the most popular one among employers to deposit a regular worker’s wage into the bank account. With it, the payroll processes are simplified and workers get the pay on time.

2. Social Security direct deposit form.

Arranged for individuals receiving Social Security benefits to have the automatic direct deposit mail into the beneficiaries’ bank accounts. It is the duty of the SSA.

3. Veteran Benefits Direct Deposit Form

Veterans apply through this method to get their monetary shares forwarded directly to their banking account selected. This makes it effective in the control and safety of money coming from the Department of Veterans Affairs.

4. Government Pension Direct Deposit Form

Government pensioners who decide to sign up for direct deposits can submit this form to free themselves from worrying about the potential delays in the transfer of their pension payments to the bank accounts.

5. For Business-to-Business

This medium, which is very important in business deals, helps organizations pay vendors, contractors, and suppliers electronically. It ensures the smooth transaction of the business’s financial operations.

Key Components of a Direct Deposit Form

The following are the key components that you can typically find in a direct deposit form:

- Employee Information: This sub-section captures some simple details of the employee which include name, address, social security number, and contact details. It is crucial to ensure that information is provided accurately so the fund is credited to the receiver’s account.

- Bank Details: In this part, keying in the employee’s bank information will be a prerequisite. Information such as the name of the bank, routing number along account number is also an essential detail. It is critical that all these aspects are verified or the transaction could be purposefully delayed or be a complete failure.

- Deposit Amount: Here, workers have the chance to put in the amount that they want to go into their hair. This means that they can put a minimum of how much they will deposit, by depositing a fixed amount or a certain percentage of their income.

- Account Type: Employee may select from either a check or savings account to be a direct deposit bank account. They also need to fully inform their clients on whether they are creating a single account or a shared one.

- Authorization Signature: This paragraph is the employee’s signatory of the fact that their employee can pay their salary directly into the account of the bank, which is chosen by him. It acts to duplicate the statements made in the deposition and verifies that all facts are correct.

- Company Information: Some direct deposit forms might be like the one including the company information for receipt which includes the name, address, and ways to contact the company.

- Effective Date: This stipulates the date when the wage deduction will come into effect. It is normal practice to either wait until the next paycheck or a certain date requested by the employee and then process the payment at that time.

Benefits of Using a Direct Deposit Form

The use of direct deposit forms helps in handling the transactions privately and quickly. Here are some key benefits of using a direct deposit form:

Convenience

A benefit worthy of mention is the level of convenience paid by direct pay slip form option. Employees and employers, respectively, do not have to do with the paperwork and physical checks anymore. The fund is safely and conveniently transferred to a checking or savings account through the auto-deposit process, this will make the process safe and less prone to errors.

Security

With direct deposit, the financial transactions of customers experience a notable level of confidentiality. It mitigates the chance of getting missing or misused checks and curbs the level of potential crime. That being the case, the money transfer is performed electronically thus the most confidential financial information is saved.

Timeliness

When made with direct deposit, payments become more efficient in the financial space as compared to typical checks. Mail is not required for anyone waiting for a check to be sent, delivered, and then deposited. Hence, it guarantees that workers are paid their wages on time and the dot, all the time, which enhances a stable financial environment.

Cost-Effectiveness

For employers, paper checks are eliminated, which makes human resources department jobs cheaper. It is less costly compared to any other check services involving printing, handling, and mail. Also, it might reduce the quantity of work for the clerks, in that payrolls will be automized.

Environmental Impact

Wordless processes with direct deposit forms are one of the environmentally friendly approaches to save nature as it eliminate the need for paper. It is much of the business operation that helps to minimize paper waste which then gives rise to sustainable process and green enterprise operation.

How do I get a Direct Deposit Form?

To get the forms for direct deposit, just follow our steps below. First, contact your employer’s human resources or payroll department requesting your direct deposit form; this way of remittance is commonly given as an emphasis to employees. Of course, you may also find the form through your bank’s online website or by visiting their branch offices in case it is necessary.

In addition to that, some banks have also online forms with the possibility of filling and submitting them online. Next, when you receive the form, you need to fill in bank account details along with the routing number and the account number. At this point, you should also include all other personal data that is required. After filling in the form, hand it to the Human Resources directing department so this department can set up your direct deposit.

How to Fill Out a Direct Deposit Form

Completing a direct deposit form online is much easier than removing money from your account as your paychecks will be automatically deposited into your bank account.

Follow these steps:

- Obtain the Form: Get a direct deposit form from either your employer or their financial institution.

- Personal Information: Complete the “Your Details” section by inputting your full name, address, and contact information.

- Bank Information: Write out the name and address of your bank. Account Number: Provide your bank account details. This is a special number that helps to associate your account with your individual.

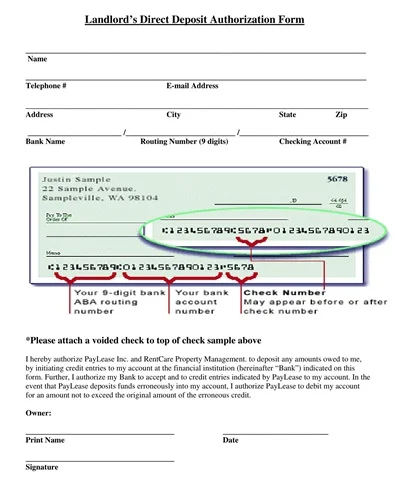

- Routing Number: Ensure that you input the bank’s ABA routing number (nine-digit code that identifies the financial institution) correctly.

- Account Type: Specify the type of account whether it is checking or savings.

- Signature: Fill in that field and date the form to permit direct deposits to go through.

- Submit the Form: Please fill out the form completely and submit it either to your supervisor or the payroll office.

With the following plan, you will have a properly set up direct deposit (so you won’t have to struggle to manage your budget).

What do you need for a Direct Deposit Form?

Filling out a direct deposit form needs a few crucial details which are inputted in the form to get your payments processed without any problem First of all, you will have to provide your account details which comprise of routing number and account number. You will find normally two of these numbers which can be found on a cheque or through your bank online portal.

Another thing that you will be supposed to do is give the name and address of the bank. Furthermore, several types of documents require private information like your full name, physical address, or even your social security number as proof of your identity. Another one of these is an application for the money to be deposited into your bank account often a void cheque is asked to confirm the proper information of your bank account. Save yourself the trouble of the I don’t know how to set up my direct deposit. With all these details handy, you can avoid the troubles of direct deposit setup.

How to Create a Direct Deposit Form Template

The creation of a direct deposit form template includes several key steps that should be followed to help record the full details and to keep it secure.

Step 1: Data Gathering.

Firstly, identify the information that must be included in the direct deposit form such as the bank account number, and routing number among others. This typically includes:

- Employee’s full name

- Employee’s address

- Employee ID or social security number

- Bank name and branch

- Bank account number

- Bank routing number

- Type of account (checking or saving).

- Authorization signature and date

Step 2: Construct the Outline

Develop a systematized design that avoids complexity and allows for clarity. Use a neat and formal layout with sections that relate to each category of information respectively. For example:

Section 1: Personal Information

- Full Name

- Address

- Employee ID/Social Security Number

Section 2: Bank Information

- Bank Name

- Bank Branch

- Account Number

- Routing Number

- Account Type

Section 3: Authorization

- Signature

- Date

Step 3: Introduce Legal Disclaimers

Provide a provision for the legal disclaimer that explains the objectives of the form and includes all the T&Cs if applicable. This can include:

- A declaration to the employer that explains consent to deposit funds in the specific bank accounts.

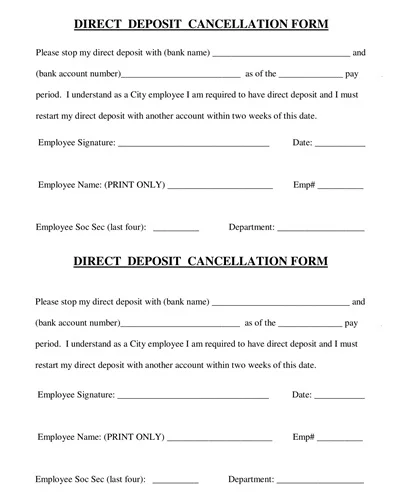

- Instruction on the process of stopping or changing the automatic wage deposits.

- Insured privacy and data protection guidelines

Step 4: Instruct Clearly

Incorporate instructions in the described area to guide employees through the process of filling out the form. Provide a clear description of each field and give relevant examples where needed. This makes the application smoother and it is less likely that the form will be filled in incorrectly.

Step 5: Feedback and Evaluation

Just before finalizing the template, go through it properly to find any misspellings or missing information. In addition, it is advisable to test the form with several employees or stakeholders to manage expectations and make any required adjustments if necessary.

Step 6: Final and Spread

After the template has been prepared and is proofread with care, save it in a widely accessible format like PDF or MS Word. Disseminate the template using the proper channels e. g., the company’s intranet, email, or HR department, to make sure all employees can easily get the form and complete it.