20+ Restaurant Profit and Loss Statement Templates (EXCEL, PDF)

A restaurant profit and loss statement template is an invaluable tool for keeping your business running smoothly. Properly evaluating your receipts, expenses, and profits will be essential in ensuring the continued success of any restaurant.

Table of Contents

By taking advantage of these templates, you can quickly review the financial health of your business and make well-informed decisions moving forward. Whether you are tracking inventory costs or calculating payroll taxes, these templates take the hassle out of analyzing the financials and allow you to focus on key aspects of running a successful restaurant.

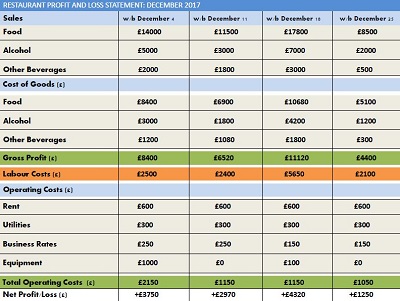

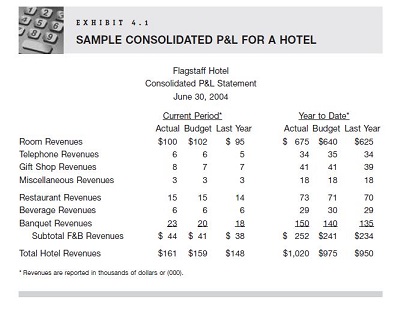

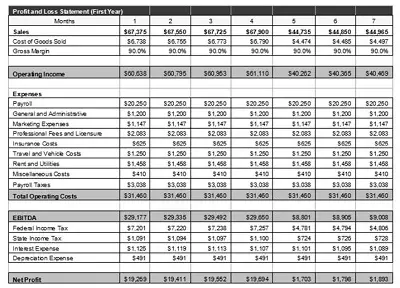

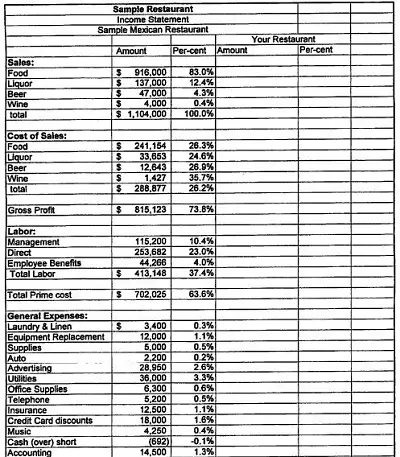

Download Free Restaurant Profit and Loss Statement Templates

What Is a Profit And Loss Statement?

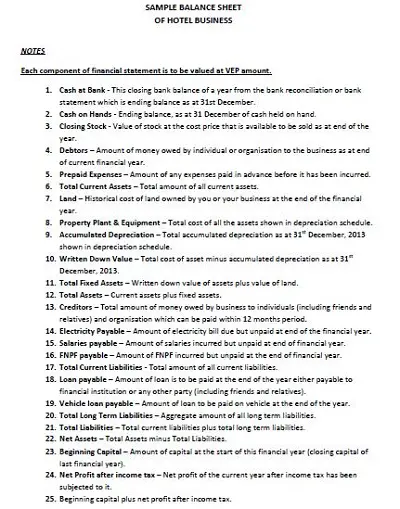

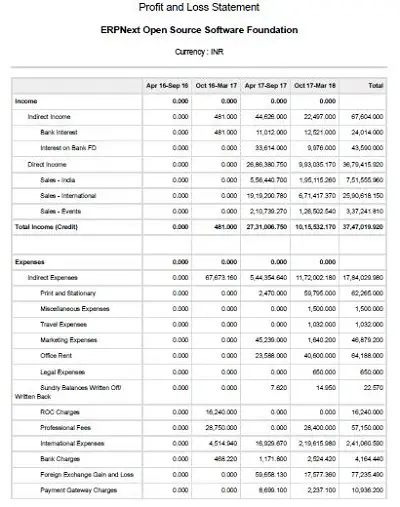

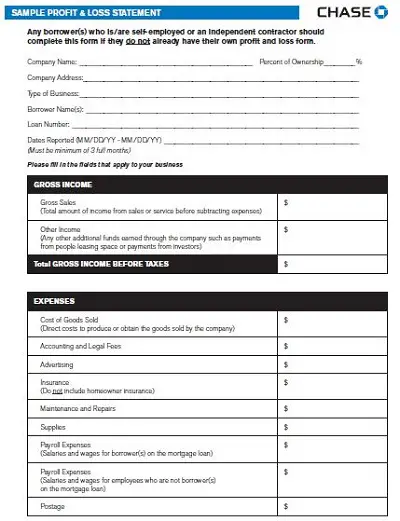

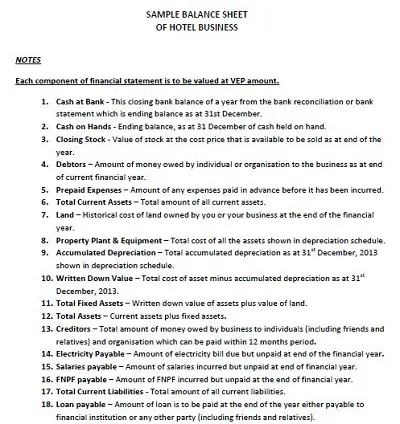

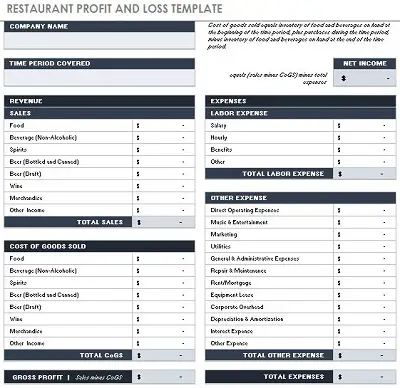

A Profit And Loss statement is a financial document that summarizes the revenues, costs, and expenses incurred by a business during a specific period of time usually one year. The two main components of a profit and loss statement are the “gross profit” (revenue minus cost of goods sold) and the “net income” (gross profit minus operating expenses). It’s important to note that while these terms are related, they are not exactly the same thing. Gross profit represents the total amount of money left after subtracting all costs associated with producing or selling products or services from total revenue; net income takes into account all other expenses unrelated to production or sales such as rent, utilities, marketing costs, etc.

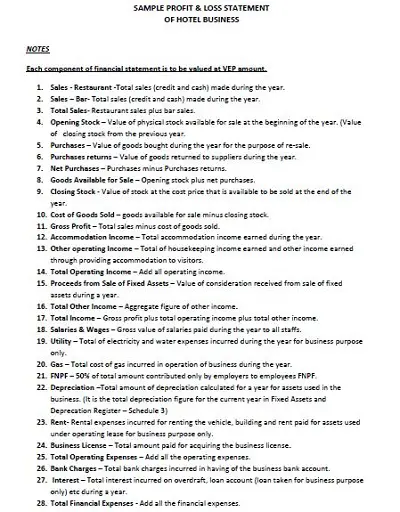

Understanding Your Restaurant’s Profit & Loss Statement

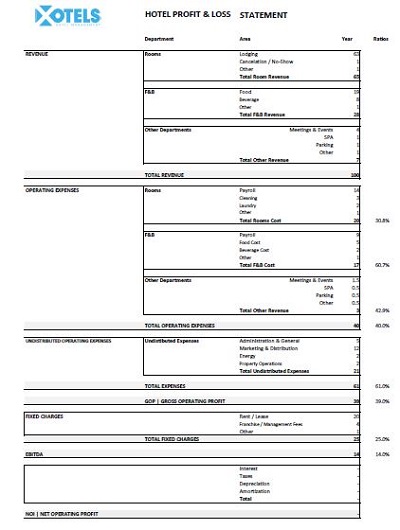

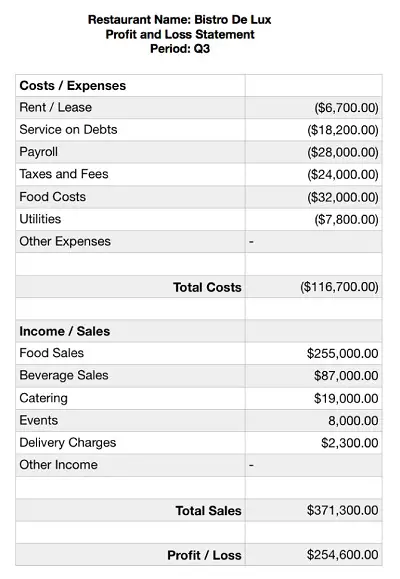

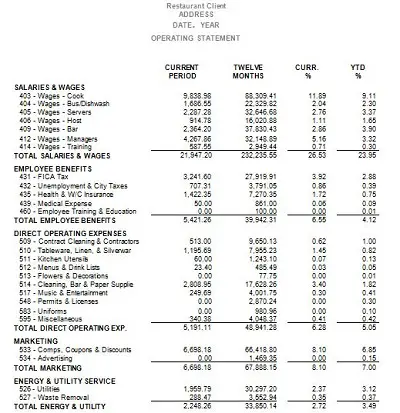

A restaurant’s profit & loss statement will typically contain information about sales numbers (including averages), cost of goods sold (COGS), labor costs, operational expenses like rent and utilities, taxes paid on profits or losses earned during the period in question, and more. By understanding each component of your restaurant’s profit & loss statement, and keeping track of them over time you can gain valuable insights into where your restaurant stands financially. This can help you make better decisions about how to allocate resources in order to maximize profits in the future.

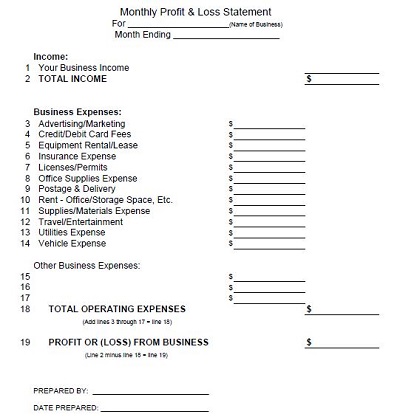

Key Components of Your Profit & Loss Statement Template

Your profit and loss statement templates should include all income generated from sales, minus any costs associated with running the business such as payroll, rent, utilities, food supplies, etc. It should also include any other expenses related to operations such as advertising and marketing costs. At the end of the document, you will see an overall net income (or loss). This number will tell you whether your business is making money or not.

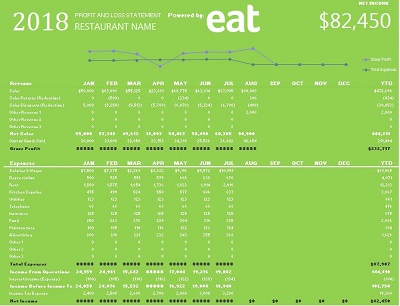

In addition to tracking general income sources and expenses, many restaurants use their template to track customer data such as average order size and the number of orders placed per day/week/month, etc. This type of data can help inform decisions about menu changes or promotions that may increase sales in certain areas.

Why Use a Template?

Using a template for creating a Profit and Loss Statement makes the process simple and less time-consuming for busy restaurant owners who need to focus on their day-to-day operations. A template will provide all the necessary sections for you to enter data into such as sales information, cost of goods sold, labor costs, rent payments, etc., as well as space to enter any additional information related to other expenses related to running your business like marketing or advertising campaigns. Templates also allow you to easily compare different periods of time so that you can track progress over time or spot potential areas where changes need to be made quickly in order to improve profitability.