34+ Free Printable Retirement Planning Checklist Templates (Doc, PDF)

Retirement planning ensures you maintain your desired lifestyle post-retirement and meet any unexpected expenses. The retirement planning checklist is a document that structures plans logically and thoroughly. It simplifies the process and provides a clear view of your retirement goals and the steps needed.

Table of Contents

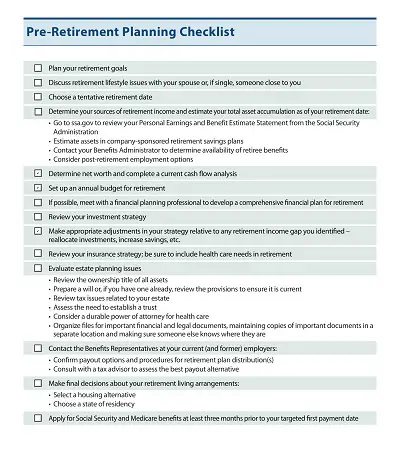

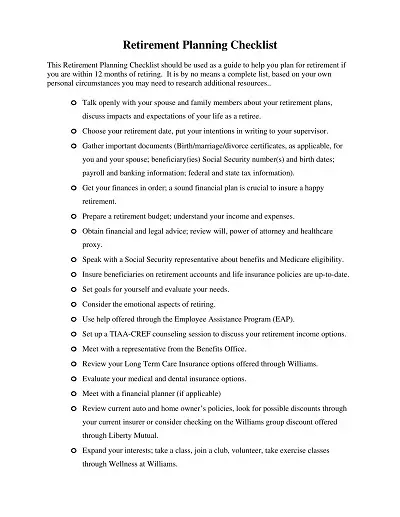

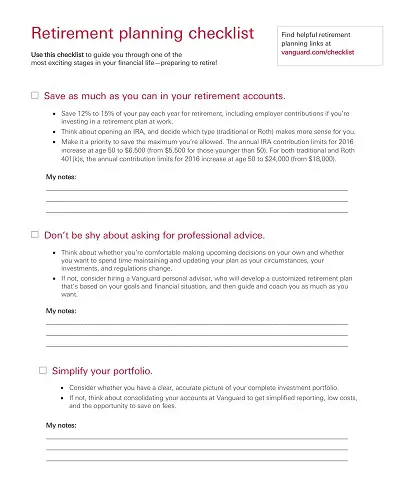

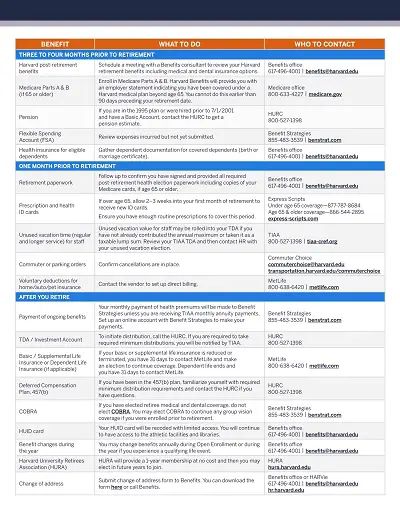

Our retirement planning checklist templates act as a roadmap and include essential components of retirement planning, like savings, investments, health considerations, lifestyle planning, and estate management. These elements play a significant role in shaping a secure, fulfilling, and worry-free retirement.

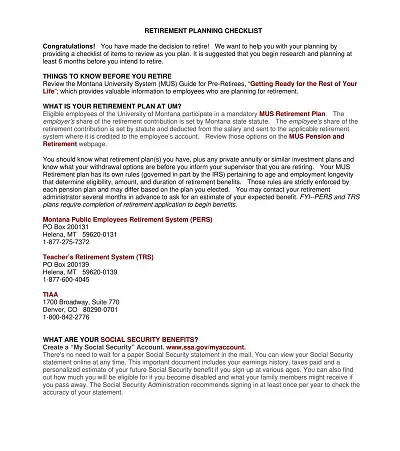

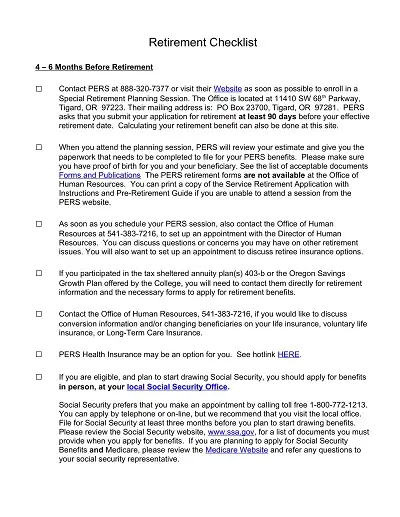

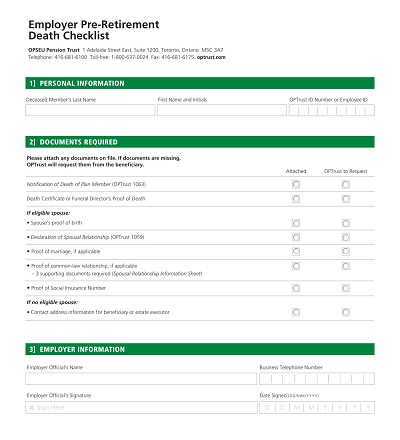

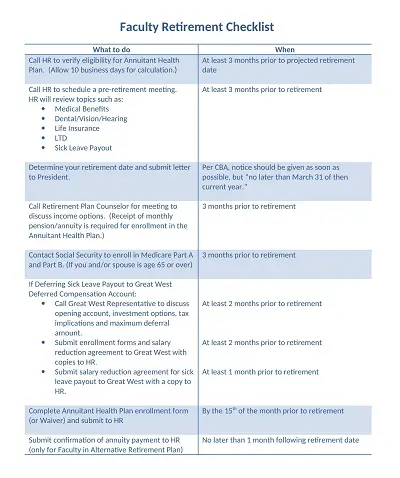

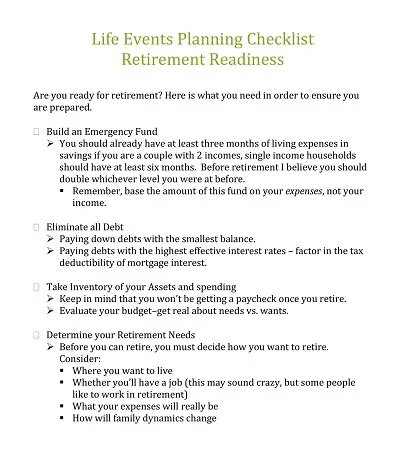

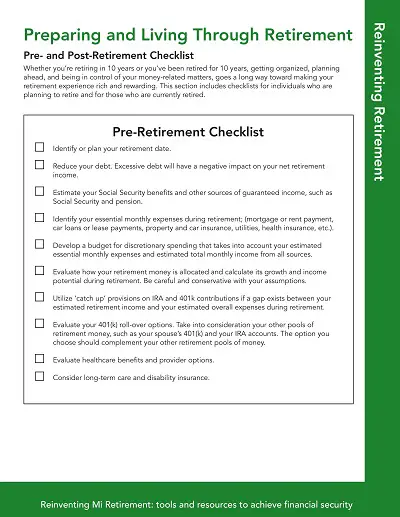

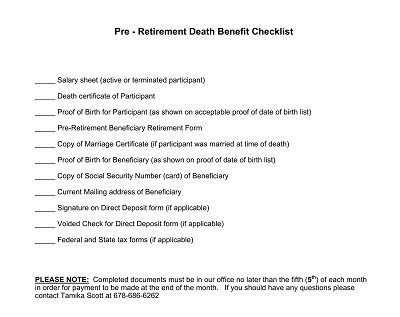

Download Free Printable Retirement Planning Checklist Templates

Overview of Retirement Planning

It’s the process of determining retirement income goals and deciding on the necessary actions to achieve them. It is a comprehensive, long-term approach to ensuring financial security during the golden years of life. Retirement planning includes factors like:

- How long one anticipates to work?

- What kind of lifestyle does one wish to have post-retirement?

- Estimated budget for future living expenses and healthcare needs!

Retirement planning isn’t about putting a portion of your earnings into a savings account; it is about creating a safety net that ensures financial stability in your later years. It provides financial security and allows retirees to enjoy their golden years without financial stress. It is the foundation of a stress-free, financially stable retirement. The templates below the retirement planning checklist help simplify the complex and multi-faceted process. It would be easier for individuals to plan effectively for their golden years.

Critical Components of a Retirement Planning Checklist

Here are the seven key components of a retirement planning checklist:

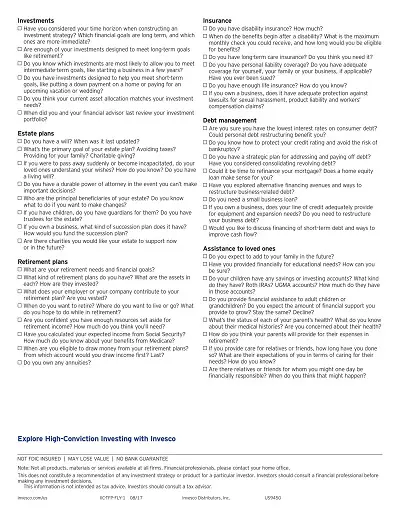

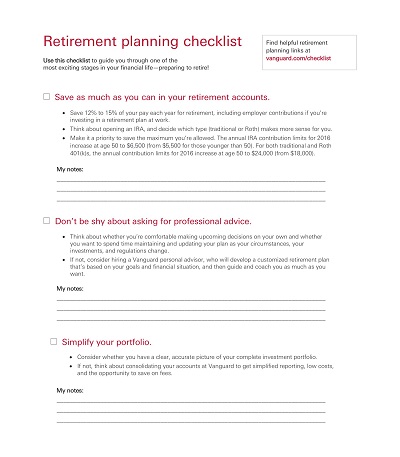

- Savings and Investment Strategies: This is the base of any retirement plan. From 401(k)s and IRAs to mutual funds and real estate, the Checklist should help you identify the proper investment routes that align with your retirement goals.

- Health and Medical Considerations: As you age, healthcare becomes increasingly essential. The planning check should encourage you to assess your potential healthcare costs. Consider factors like Medicare, long-term care insurance, and out-of-pocket medical expenses.

- Lifestyle Planning Post-Retirement: Imagine your ideal retirement lifestyle. Would you travel extensively, pick up new hobbies, or relocate? Include these life changes and these associated costs in the Checklist.

- Estate Planning: It Covers wills, trusts, and your wishes for your assets after your lifetime. It’s a complex topic, but using an appropriate checklist will help you to start these critical conversations and plans.

- Debt Management: Entering retirement with debt can strain your finances. This section includes strategies for paying down debt before retirement.

- Social Security Benefits: Understanding when and how to claim your benefits can significantly impact your retirement income.

- Inflation and Cost of Living Adjustments: Consider the influence of inflation on your retirement savings and expenses.

Why Use a Template for Retirement Planning Checklist?

A Template for retirement checklist can be a game-changer; it provides a roadmap to a secure, fulfilling retirement. Break down the complex task of retirement planning into manageable sections.

You can navigate the complex web of financial, medical, social, and lifestyle decisions, including retirement planning. With a template, you don’t have to start from scratch. It helps you identify and organize critical considerations and ensure no significant aspects are overlooked.

These templates are pre-designed to be user-friendly and adaptable to your unique retirement goals. Using a template simplifies the process while ensuring effective retirement planning. Ultimately, it builds confidence and peace of mind for your journey towards golden years.

How Can I Make a Retirement Planning Checklist Template?

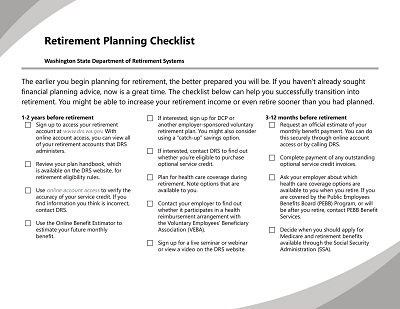

To design a template that is both comprehensive and personalized to your retirement planning needs, follow these steps:

- Start with Your Retirement Goals: Begin your template by defining your retirement goals. What does your ideal retirement look like? Do you envision traveling the world, pursuing hobbies, or spending quality time with loved ones? These goals will guide the financial planning elements of your Checklist.

- Identify Income Sources: The next section of your Checklist should review all potential income sources during retirement. These could include Social Security benefits, pensions, 401(k)s or IRAs, rental income, or part-time work.

- Assess Your Expenses: After income, you’ll want to consider your anticipated expenses. Include daily living expenses, healthcare, travel plans, and hobby expenses. Remember, some costs may decrease in retirement, while others, especially healthcare, may increase.

- Plan for Health and Medical Expenses: Anticipating possible healthcare costs is critical to retirement planning. Ensure your Checklist includes a section dedicated to health insurance, Medicare, long-term care insurance, and out-of-pocket medical expenses.

- Include Debt and Estate Management: If you have ongoing debt, plan to pay it down before retirement. Also, consider estate planning, like drafting a will and setting up confidence to manage your assets after your lifetime.

- Adjust for Inflation: Remember the potential effect of inflation on your retirement savings and expenses. Incorporate this into your template to adjust your plan accordingly over the years.

How to Use Our Retirement Planning Checklist Template

Using our templates is as easy as ABC. Here’s a step-by-step process for hassle-free usage.

- Objective of Planning Checklist: The Checklist aims to help you better understand your retirement aspirations and financial needs. What are your retirement goals? How much savings will you require to live comfortably during retirement? Reflect on these questions to better understand your needs.

- Select a Template: Browse through the collection of templates for the Retirement Planning Checklist. Each template meets different retirement goals and scenarios. Select one that best aligns with your needs.

- Download the Template: Once selected, download the template from our website. There is an easy-to-use download button for this purpose.

- Customize the Template: The beauty of our templates is in their flexibility. You can modify them according to your unique retirement goals and financial situation. Modify the categories and add or eliminate items on the Checklist to personalize it completely.

- Fill Out the Template: Fill in the details of your income sources, anticipated expenses, health and medical plans, debt management, and inflation adjustments. The more accurate the information, the more effective your retirement planning will be.

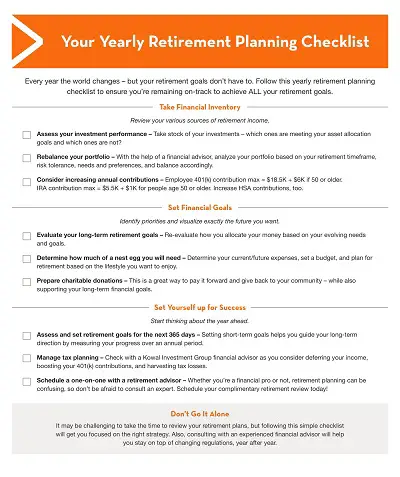

- Review and Update: Regularly review and update your retirement planning checklist to account for any modifications in your financial situation or retirement goals.

Types of Retirement Planning Checklist Templates

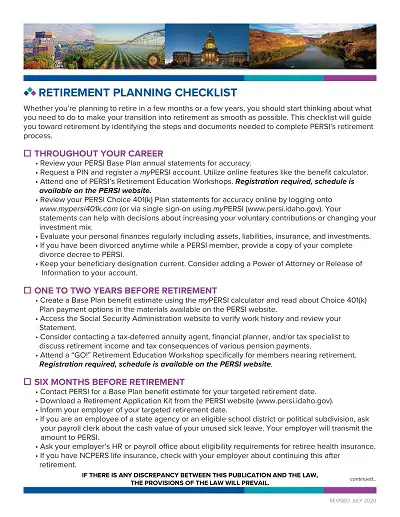

Types of templates for retirement planning checklist are:

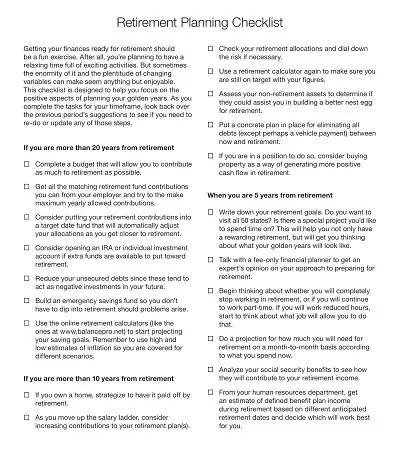

- Essential Retirement Planning Template: This template is perfect for beginners. It covers foundational aspects such as defining retirement goals, identifying income sources, assessing expenses, and planning for healthcare costs.

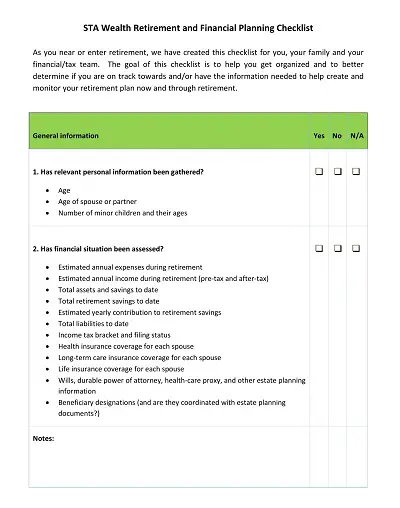

- Advanced Retirement Planning Template: Designed for individuals more profound in their careers or with more complex financial scenarios, this template provides comprehensive financial planning, including investment strategies, tax planning, and estate management.

- Retirement Travel Planning Template: If your dream retirement involves exploring new destinations, this template is for you! It includes sections for planning and budgeting for travel, ensuring you can fulfill your necessary retirement details without any worries about finances.

- Medical Retirement Planning Template: To navigate retirement with a medical condition can be challenging. Our Medical Retirement Planning Template considers extra healthcare costs and insurance needs to help you plan confidently.

- Entrepreneur Retirement Planning Template: For the self-employed or business owners, retirement planning involves unique considerations. This template helps with succession planning, valuation, and converting business assets into retirement income.

Benefits of Retirement Planning Checklist Templates

The benefits of using a template to make a retirement checklist template are:

- Simplicity: Templates distill the complex process of retirement planning into easy-to-understand steps. By breaking down the tasks, the journey becomes easy and manageable.

- Personalization: Retirement planning isn’t a one-size-fits-all process. Choose a customizable template that allows you to adapt it to your unique retirement goals and financial situation.

- Comprehensiveness: From essential financial planning to advanced investment strategies, a template covers all aspects of retirement planning.

- Time-saving: A template provides a structured approach and clear guidance. Instead of beginning from scratch, you can start with a solid foundation that meets your needs.

- Peace of Mind: You gain the confidence that you’re on the right track toward achieving your retirement goals. A template serves as a roadmap and helps you consider various stages of retirement planning. It ensures you’re well-prepared for your golden years.