12+ Free Balloon Loan Amortization Schedule Templates – MS Excel

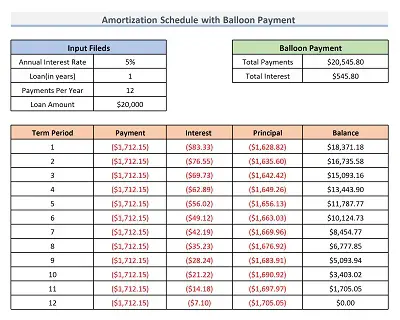

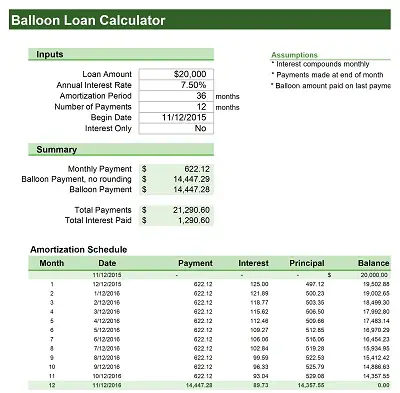

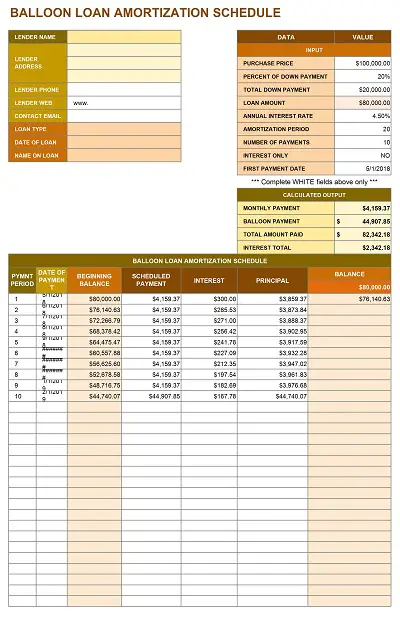

A balloon loan amortization schedule template is a valuable tool for people looking to create a payment plan for loans with balloon payments due at the end of the loan term. This type of loan differs from traditional loans because it usually has a smaller monthly payment and a large final payment due at the end of the term.

Table of Contents

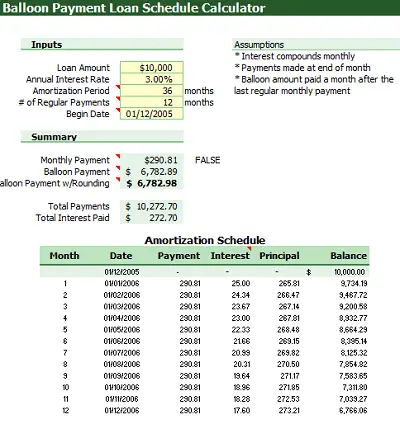

The template allows borrowers to input their loan amounts, interest rates, and terms length to estimate their potential repayment costs over time. In addition, this template also offers helpful information on fixed-rate options and variable-rate discounts associated with balloon notes to track your payments. With its intuitive design, this powerful template can easily connect borrowers with the right repayment plans that fit their financial goals.

Download Free Balloon Loan Amortization Schedule Templates

How does Balloon Loan Amortization Schedule Work?

A Balloon Loan Amortization Schedule is a type of loan that involves making a series of payments over a certain period. At the end of this period, the final payment is called the balloon payment which is much larger than the other payments that are due. Some essential things to consider when creating an amortization schedule are the repayment amount, interest rate, and length of the loan.

Furthermore, with a Balloon Loan Amortization Schedule, you can make payments each month to reduce your total balance paying off interest as well as principal while building equity in your home. In addition, it helps make more accurate estimates of what to expect when it comes to refinancing or selling in life. Establishing an amortization schedule helps prepare both borrowers and lenders by offering hard data on which to base their expectations.

Understanding Balloon Loan Amortization Schedule

A balloon loan amortization schedule is a helpful tool for better understanding loan payments and the resulting interest savings. This type of payment structure is beneficial because it allows borrowers to take advantage of lower monthly payments while still paying off their loans within a given term.

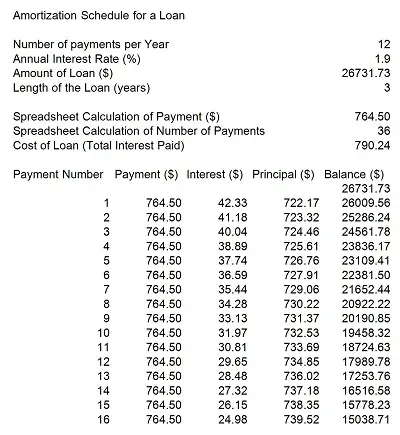

Balloon loans are best used by those who plan to make extra principal payments over time, as they can significantly reduce the total amount paid in the long run. To understand the impact of such a payment plan, studying an amortization schedule can be a great resource. This document details the amount of money applied to principal and interest at each payment period, which then helps borrowers determine if this approach fits in with their financial goals.

Pros and Cons of Balloon Loan Amortization Schedule

A balloon loan amortization schedule can provide relief to someone facing a large financial commitment. With this type of loan structure, the borrower can pay off the full balance by a specific date rather than stretch the payments out over many years.

However, it is important to consider carefully before taking on this type of loan, if the full payment cannot be made when due, the lender may require much higher payments or possibly even foreclose on the property. It’s important to evaluate the likelihood of being able to make the required payment and any potential risks involved before deciding whether a balloon loan amortization schedule makes sense for your situation.

How to Create a Balloon Loan Amortization Schedule Template

A balloon loan amortization schedule template is an effective tool that can help you manage your financial obligations. It is a detailed chart that shows how the principal balance of a loan is paid down over time. Knowing how to create this template can give you greater control over your finances and make managing your debts easier.

How it Works

A balloon loan amortization schedule follows the same principles as any other type of loan, with one major difference: the borrower pays back the entire principal balance in one lump sum payment at the end of the term hence the “balloon” in its name. This type of loan works well if you have an irregular income or need more flexibility in terms of repayment.

Creating Your Template

To create your balloon loan amortization schedule template, start by listing out all relevant information about your loans such as the total amount borrowed, interest rate, repayment period, and due dates for each installment payment. Next, calculate the monthly payments based on these factors and list them in order from the earliest due date to the latest due date. Lastly, add up all of the monthly payments to get your total repayment amount at the end of the term.

Now that you have all of this information compiled in one place, you can easily keep track of your financial obligations by periodically reviewing and updating your template as needed. You can also use it to quickly compare different loans to see which one best fits your needs before making a decision.