30+ Free Sample Independent Contractor Agreement Templates

An Independent Contractor Agreement Template is a legal document used to establish the terms and conditions of a working relationship between a hiring party (often referred to as the “client” or “employer”) and an independent contractor.

Table of Contents

This type of agreement outlines the scope of work, payment terms, confidentiality obligations, intellectual property rights, termination clauses, and other important provisions.

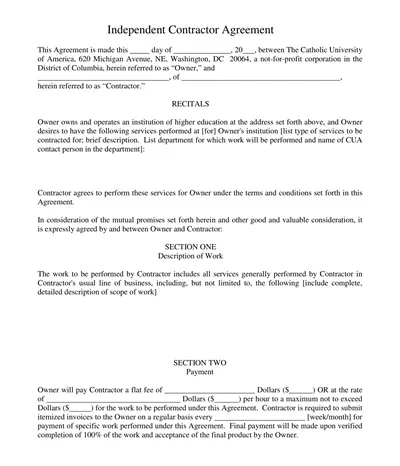

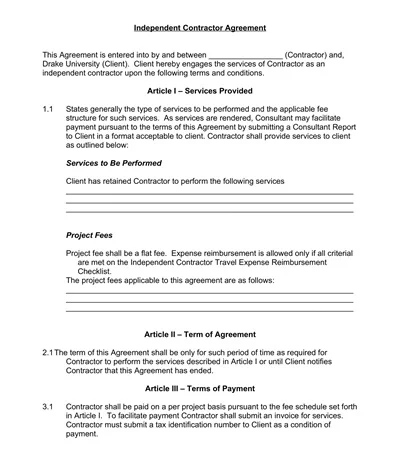

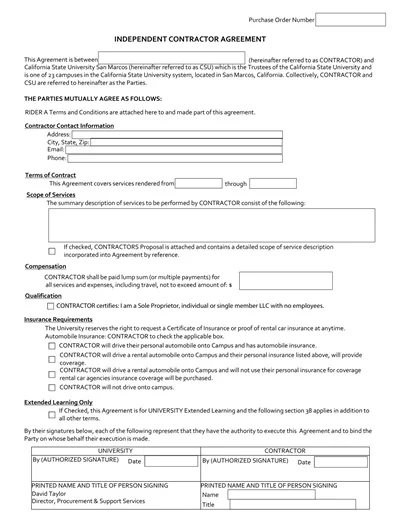

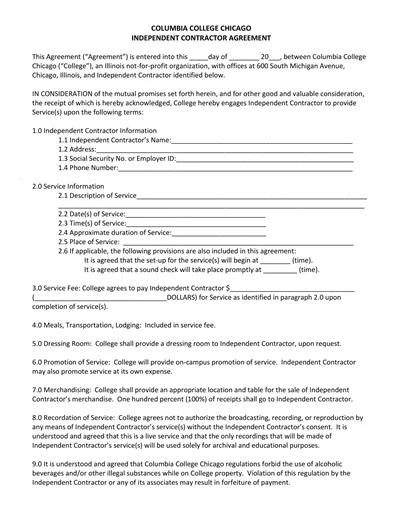

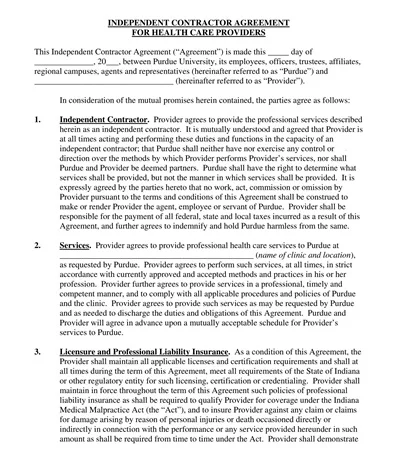

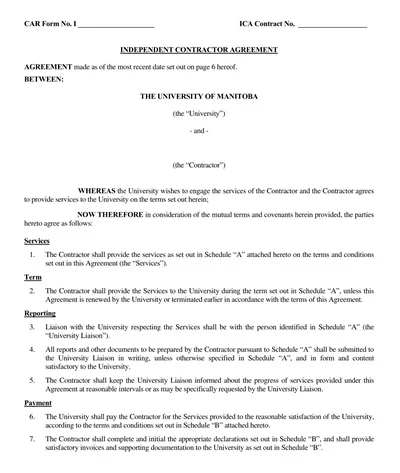

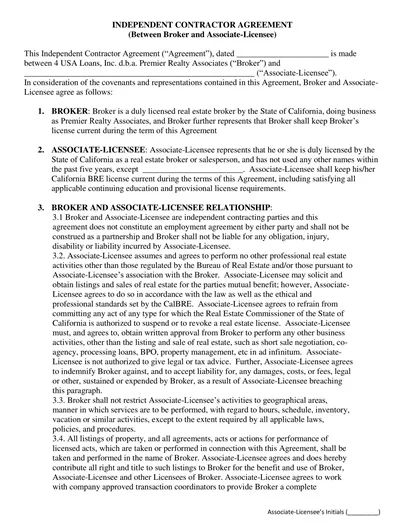

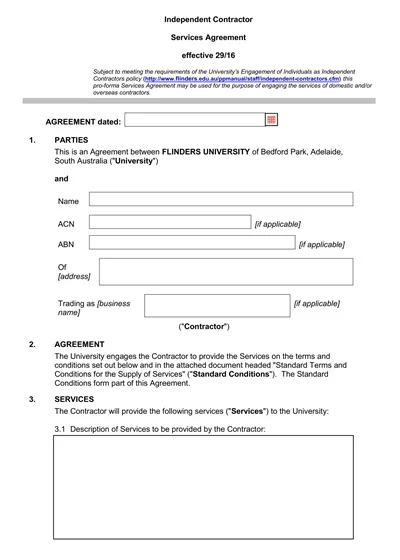

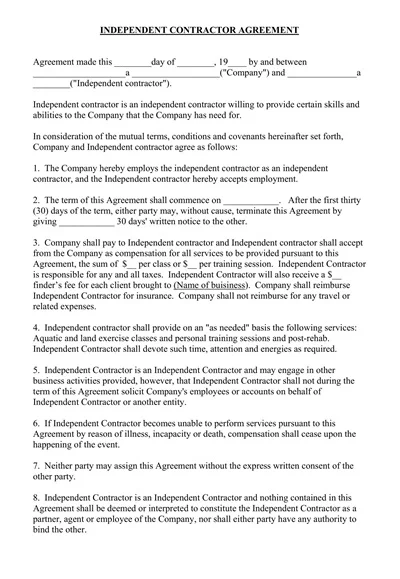

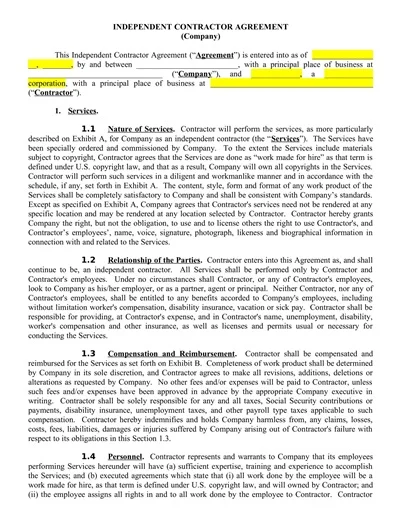

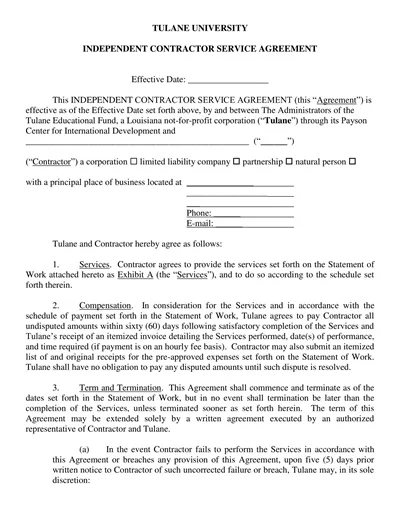

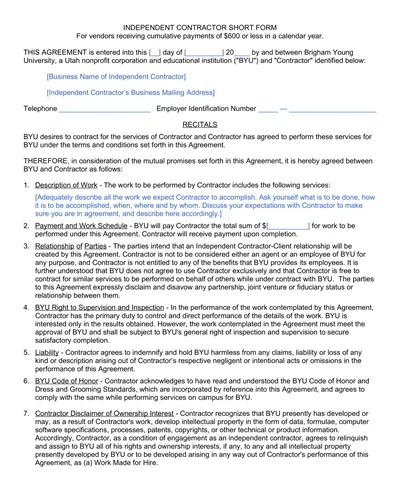

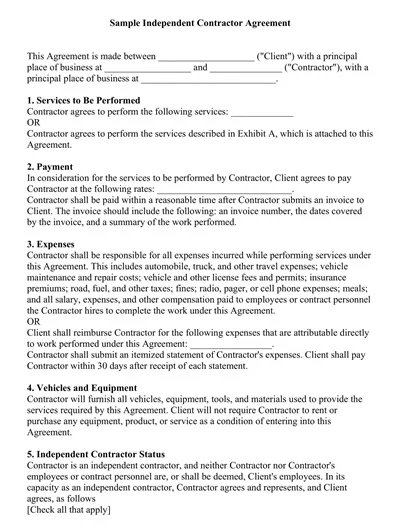

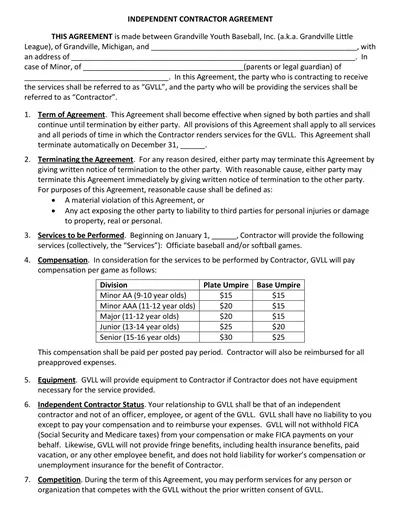

Download Free Sample Independent Contractor Agreement Templates

What is an Independent Contractor Agreement?

An independent contractor agreement is also known as a freelance contract, is a legally binding document between a service provider (freelancer) and a client (often a small business).

This agreement outlines the scope of work to be performed, payment details, deadlines, confidentiality clauses, and any other terms that govern the working relationship. Essentially, it serves as a roadmap for the project and a safeguard for both parties.

Why is an Independent Contractor Agreement Important?

- Clarity and Scope: It clearly defines what is expected from both the freelancer and the client, including the scope of work, deadlines, and deliverables. This minimizes misunderstandings and sets clear expectations.

- Legal Protection: It offers protection if disputes arise. For instance, if there’s a disagreement about payment or the scope of work, the agreement serves as a reference point that can help resolve issues or serve as evidence in a legal dispute.

- Compliance and Tax Purposes: It helps to establish the freelancer as an independent contractor rather than an employee, which has significant tax implications for the client and affects the freelancer’s tax filing status.

- Professionalism: Using a formal agreement reflects professionalism and shows that you’re serious about your business. This can enhance your reputation and potentially lead to more business opportunities.

What should be included in an Independent Contractor Agreement?

An Independent Contractor Agreement is a crucial document that outlines the terms and conditions of the working relationship between a hiring party (often referred to as the “client” or “employer”) and an independent contractor.

Here are the key components that should be included in an independent contractor agreement:

Identification of Parties

The agreement should clearly identify the parties involved, including the client (referred to as the “company” or “client”) and the independent contractor (referred to as the “contractor”).

Scope of Work

This section outlines the specific services or tasks that the independent contractor will perform for the client. It should provide detailed descriptions of the project or job duties, including any deliverables, deadlines, and milestones.

Payment Terms

Specify how and when the independent contractor will be compensated for their services. This may include an hourly rate, project-based fee, or other payment structure. Detail invoicing procedures, payment schedules, and any expenses that will be reimbursed.

Relationship of the Parties

Clarify that the independent contractor is not an employee of the client and that they are acting as an independent business entity. This section helps establish the contractor’s status as a separate entity for tax and legal purposes.

Confidentiality and Non-Disclosure

Include provisions to protect confidential information belonging to the client. The contractor should agree not to disclose or use any confidential information obtained during the course of the contract for any purpose other than fulfilling their obligations under the agreement.

Intellectual Property Rights

Address ownership of any intellectual property created during the contractor’s work. Specify that the client retains ownership of any work product, and outline any rights and licenses granted to the client for the use of intellectual property.

Term and Termination

Specify the duration of the engagement and the circumstances under which either party may terminate the agreement. This may include provisions for termination for cause (e.g., breach of contract) and termination without cause (e.g., upon written notice).

Indemnification

Outline the responsibilities of each party in the event of legal claims or disputes arising from the contractor’s work. This provision typically requires the contractor to indemnify and hold harmless the client from any claims, damages, or liabilities resulting from their actions.

Insurance Requirements

Specify any insurance coverage requirements that the contractor must maintain during the term of the agreement, such as general liability insurance or professional liability insurance.

Governing Law and Jurisdiction

Specify the jurisdiction and governing law that will apply to the agreement, as well as any dispute resolution procedures (e.g., arbitration or mediation).

Miscellaneous Provisions

Include any additional clauses covering topics such as warranties, assignment of rights, subcontracting, or amendments to the agreement.

Key Situations Requiring an Independent Contractor Agreement

Here are some key situations requiring an Independent Contractor Agreement:

1. Defining the Scope of Work

- Why it’s important: An ICA clarifies what work needs to be done, the deadlines, and the expected outcomes. This helps manage expectations on both sides and provides a clear roadmap for the project.

- Example scenario: A graphic designer hired to create a series of marketing materials for a company’s new product launch.

2. Clarifying Payment Terms

- Why it’s important: It specifies the rate (hourly, per project, etc.), payment schedule, and invoicing requirements, preventing disputes over money.

- Example scenario: A software developer working on a custom application for a business, where payments are milestone-based.

3. Establishing Intellectual Property Ownership

- Why it’s important: The agreement can stipulate who owns the work product, which is particularly crucial in creative or technical fields.

- Example scenario: A freelance writer producing content for a website; the agreement ensures the client owns the published content.

4. Limiting Liability

- Why it’s important: An ICA can include clauses that limit the liability of both parties and specify insurance requirements.

- Example scenario: An independent contractor installing expensive equipment might need to have liability insurance as stipulated by the agreement.

5. Maintaining Confidentiality

- Why it’s important: If the contractor has access to sensitive information, a confidentiality clause protects the client’s proprietary information.

- Example scenario: A consultant hired to analyze a company’s internal processes.

6. Complying with Tax Obligations

- Why it’s important: Clearly distinguishes the contractor from an employee, affecting tax responsibilities and benefits.

- Example scenario: Hiring an event planner for a corporate function, where the planner is responsible for their own taxes.

Difference Between an Independent Contractor and an Employee

Distinguishing between an independent contractor and an employee is essential for legal, tax, and operational purposes. Here’s an overview of the key differences between the two:

Independent Contractor

An independent contractor is an individual or entity that provides services to another party under the terms of a contract or agreement. Independent contractors are distinct from employees in that they operate as separate businesses and are not considered part of the hiring party’s workforce. Instead of being employed by the hiring party, independent contractors are self-employed and are responsible for managing their own business affairs.

An Employee

An employee is an individual who is hired by an employer to perform work in exchange for compensation. Unlike independent contractors, employees are typically part of the employer’s workforce and work under the direction and control of the employer.

Benefits of Using an Independent Contractor Agreement

- Clarity and Direction: Both parties have a written understanding of their roles and responsibilities, reducing misunderstandings.

- Legal Protection: In case of disputes, the agreement serves as a point of reference for resolving issues.

- Professional Relationship: Formalizing the arrangement promotes a professional working relationship and sets the tone for successful collaboration.

- Flexibility: ICAs allow for flexible working arrangements suited to project-specific or short-term needs.

How To Write an Independent Contractor Agreement

In the current gig economy, independent contractors play a pivotal role in the success of businesses across industries. Whether you’re a startup founder, a small business owner, or a manager in a large corporation, knowing how to draft a comprehensive and clear independent contractor agreement is essential. This contract not only clarifies the relationship between parties but also ensures a smooth workflow and minimizes potential misunderstandings.

Here’s a step-by-step guide to help you create an effective agreement.

1. Understand the Importance

Before we jump into the how-tos, it’s crucial to understand why a well-crafted independent contractor agreement is important. It delineates the rights and responsibilities of both the contractor and the hiring party, outlines the scope of work, payment terms, confidentiality clauses, and provides legal protection for both parties. An agreement can serve as a reference document in case of disputes.

2. Identify the Parties Correctly

Start your agreement by clearly identifying both parties involved — the client (or hiring party) and the independent contractor (or service provider). Include legal names, addresses, and the effective date of the agreement. It’s important to specify that the relationship is that of an independent contractor and not an employment relationship, to avoid any confusion regarding employment taxes and benefits.

3. Define the Scope of Work

One of the most critical sections of your agreement is the description of the services to be rendered. Be as detailed and precise as possible to avoid scope creep and ensure both parties have the same understanding of the expected work. Include any deadlines, milestones, or specific outcomes that are expected from the contractor.

4. Outline Payment Terms

Clear payment terms are essential for a healthy working relationship. Specify the total amount to be paid, the payment schedule (whether it’s hourly, per project, or a retainer), and the method of payment. Don’t forget to mention any upfront deposits or late payment fees, if applicable.

5. Address Confidentiality and Intellectual Property

Protecting your business’s proprietary information is critical. Include a confidentiality clause that specifies what information is considered confidential and the conditions under which it can be disclosed. Additionally, clearly state who owns the work product or intellectual property created by the contractor during the course of the contract.

6. Include Termination Conditions

It’s important to specify how either party can terminate the agreement and the notice period required. This section should also outline what will happen with any outstanding payments or deliverables upon termination.

7. Plan for Dispute Resolution

Specify how disputes will be resolved should they arise. This may include mediation, arbitration, or legal action, and what laws will govern the contract. Having a dispute resolution mechanism in place can save both parties time and money if things go south.

8. Other Provisions to Consider

Depending on the nature of the work and the industry, you might need to include additional clauses, such as a non-compete clause, a non-solicitation clause, or insurance requirements. It’s wise to consult with a legal professional to ensure your contract covers all necessary aspects.

9. Review and Update Regularly

Laws and business needs change, so it’s a good idea to review and update your independent contractor agreements periodically. This ensures they remain compliant with current laws and relevant to the evolving scope of your business engagements.

10. Signatures

Finally, ensure that both parties sign the agreement. With digital contracts becoming more prevalent, electronic signatures are generally acceptable and legally binding. However, check your local laws to confirm this.