16+ Free Printable Condo Budget Templates – PDF, Excel

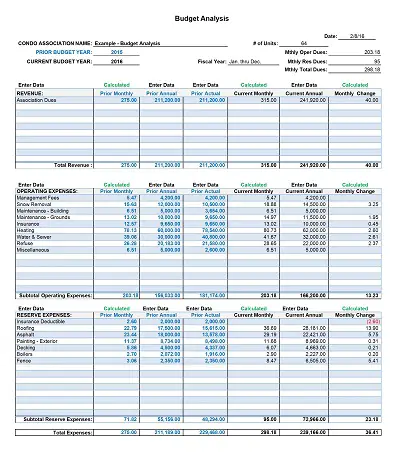

A condo budget template is a helpful and invaluable tool for managing your finances in a shared housing arrangement. It can help you to break down your sources of income, track expenses, allocate funds accordingly, and make realistic decisions on how to save up or pay bills. Condo managers and owners can coordinate effectively with each other and stay on top of their respective spaces’ financial needs.

Table of Contents

With this information, it’s easy to predict any upcoming costs or fees that need attention so that everybody involved can be prepared for the longer-term economic outlook. This resourceful planning is crucial for creating healthy financial habits that will last well into the future.

Download Printable Condo Budget Templates

Expenses to Include in a Condo Budget

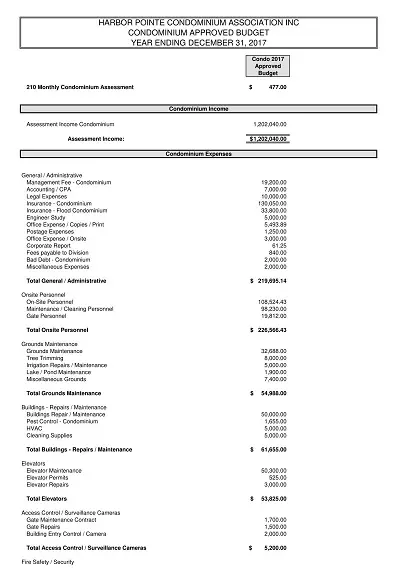

When budgeting for a condo, it is important to consider all the necessary expenses to accurately plan. Each month, renters must pay the full rent along with electricity and other utilities. Additional bills such as internet, cable, and phone services must also be considered. In addition to the fixed costs of living in a rented condo, one should keep an emergency fund of at least three months’ worth of bills in case of unexpected maintenance or repairs.

Other small miscellaneous costs such as cleaning products and laundry detergent can quickly add up so should be incorporated into the budget too. With careful planning and accurate forecasting, budgeting for a rented condo does not have to be stressful for those willing to organize their finances.

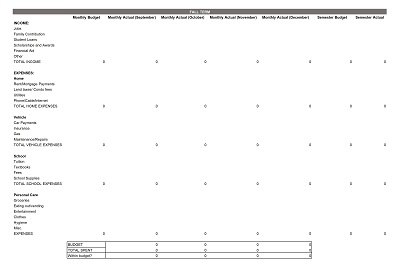

Tips For Optimizing Your Condo Budget

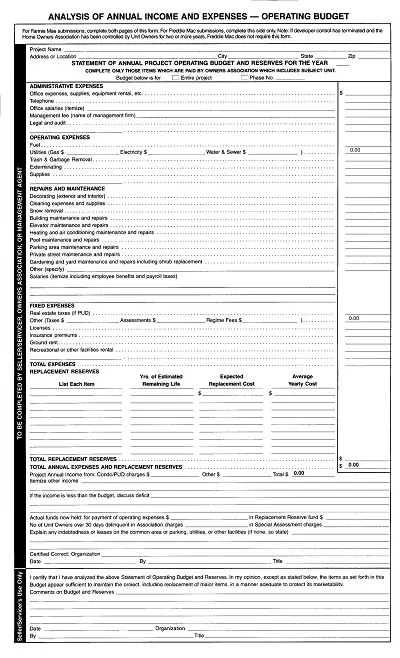

With the right tips and tools, budgets for condos can be optimized effectively and efficiently. One of the most important tips is to create a detailed tracking system for all expenses associated with the condo, such as utility bills and any necessary repairs. This will help to keep an eye on different spending areas, so you stay within your budget.

Other useful tips include regularly monitoring changes or updates in costs, such as insurance premiums or rent increases, as well as taking advantage of sales or discounts when available. Finally, it is smart to set aside money for future repairs whenever possible, this will ensure that costs aren’t too great all at once if any major repairs need to be done. By following these simple steps, it is possible to stick closely to a pre-set budget for condos and get more bang for one’s buck.

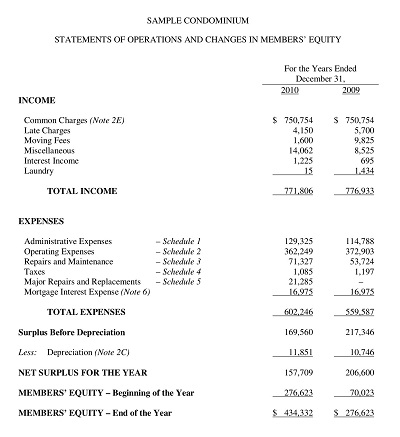

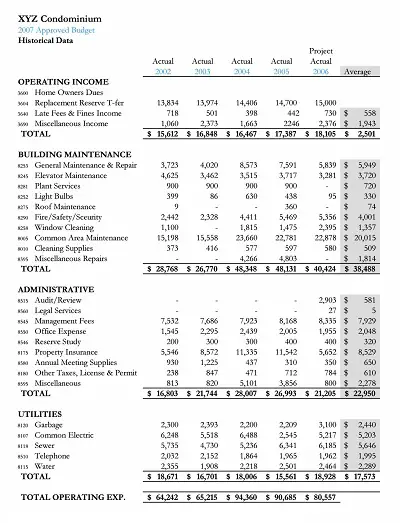

Analyzing And Projecting Income For A Condo Budget

Projecting income for budgeting a condo can be an exciting but challenging task. It requires careful consideration to determine realistic estimates that account for expected as well as unexpected changes such as fluctuating rent prices or maintenance fees.

Analyzing information such as rental occupancy rates and home values in the area can provide helpful insight when coming up with an achievable budget, allowing one to plan and stay organized with the finances. Thoughtful analysis of income can help ensure that all expenses are covered without compromising financial stability, allowing condo owners to enjoy their new space while staying in top monetary health.

How to Create a Condo Budget Template

Living in a condo is a great experience, but it can be challenging if you don’t have a budget plan in place. A budget template is an essential tool to track your expenses and manage your finances effectively. It will also allow you to identify areas where you can cut back on spending and save money.

Taking the time to create a budget template will help you achieve your financial goals and reach a comfortable financial position. Here is how you can create a budget template for your condo.

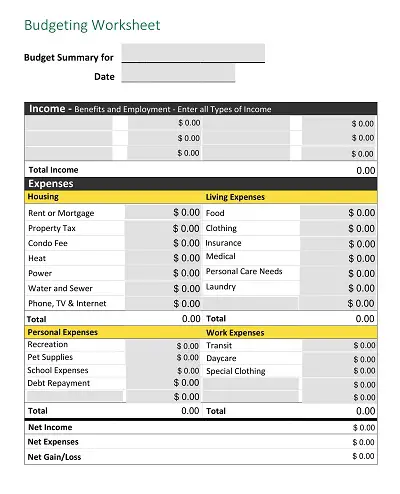

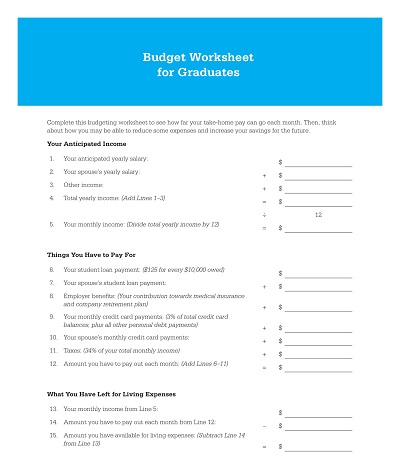

Identify Your Monthly Expenses

The first step to creating a budget template is to know how much you spend on average each month. This will help you to know your starting point and track your progress in the future. Start by listing all your monthly expenses, these can be fixed costs such as mortgage or rent, insurance, HOA fees, and property taxes. You should also include variable costs such as utilities, groceries, dining out, entertainment, and transportation expenses.

Categorize Your Expenses

Once you’ve identified your monthly expenses, start grouping them into categories such as housing, transportation, groceries, entertainment, and others. This will help you to organize your expenses and align them with your income. You can also use this opportunity to identify areas where you can cut back on spending and save money.

Determine Your Income

Apart from expenses, it’s essential to know how much money you earn each month. This can include your salary, rental income, passive income, or any other source of funds. You should also factor in any other income sources such as a partner’s income or freelance jobs.

Set Realistic Goals

After identifying your expenses and income, set financial goals. You should have both short-term and long-term goals. Short-term goals may include paying off credit card debt or building an emergency fund, while long-term goals may include saving for retirement or purchasing a second property.

Review and Adjust

Once you have created a budget template, review it regularly, and adjust it as necessary. Life is unpredictable, and your financial situation may change over time. Therefore, you should update your template to reflect these changes.