18+ Free Sample Food Pantry Budget Templates – MS Excel, PDF

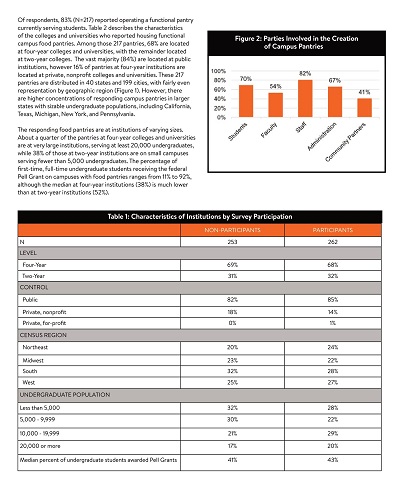

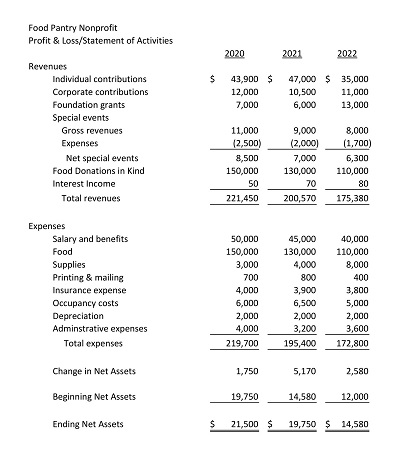

Food pantries, just like any other organization, need to have a budget that can help them maintain financial stability. With the Food Pantry Budget Template, managing finances has never been easier. The template is designed to provide a clear outline of all the expenses and income that the food pantry might encounter in a given period. From rent to utility bills to inventory expenses, the template covers all aspects of the budget.

Table of Contents

With this tool, managing a food pantry budget becomes a less daunting task, allowing food pantries to focus on their primary objective of providing food to those in need. Ensuring that every dollar is accounted for will allow for better financial planning and, ultimately, make the most of the resources available. The Food Pantry Budget Template is an asset for all food pantries that seek financial stability while serving their communities simultaneously.

Download Free Sample Food Pantry Budget Templates

Key Elements of a Food Pantry Budget

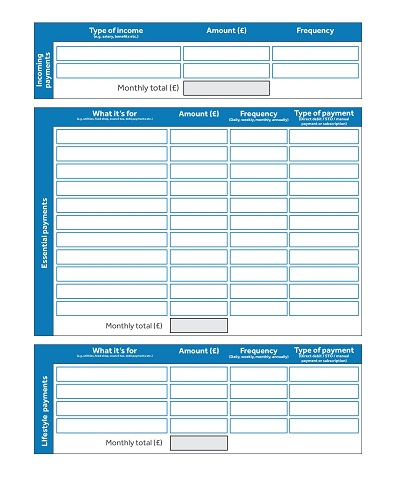

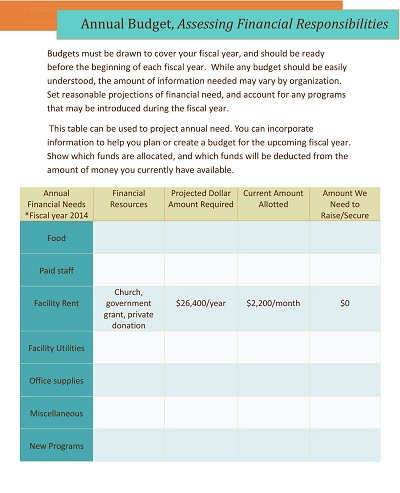

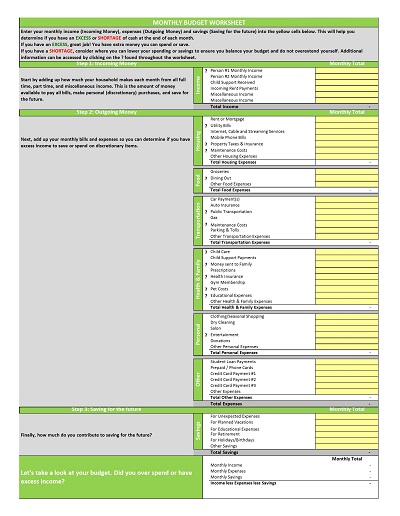

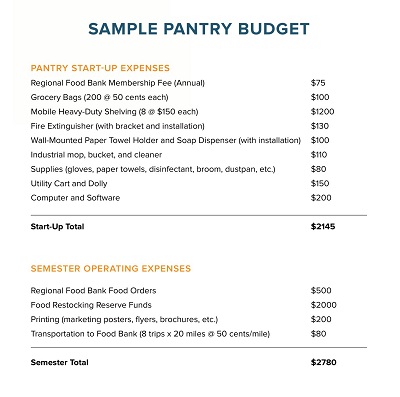

When considering a food pantry budget, it’s important to keep in mind a few key elements. Firstly, establishing goals is critical in guiding decision-making, as it allows you to prioritize your spending and ensure that you’re meeting the needs of your client base. Next, create a detailed list of expenses, which should include costs such as rent, utilities, staffing, and food purchases.

Monitoring and reviewing your expenditures regularly will help you track your progress and identify any changes that may need to be made. Finally, fundraising and community partnerships are essential in securing financial support and building relationships that can benefit your pantry in the long term. Implementing these elements into your food pantry budget will allow you to efficiently allocate your resources and provide much-needed services to those in need.

Expense Categories in a Food Pantry Budget

Budgeting is a crucial aspect of managing any organization effectively, and food pantries are no exception. One of the most significant components of a food pantry budget is expense categories. These categories can be highly variable depending on the nature of the pantry. Common categories might include food, rent, utilities, and staffing costs.

Some pantries might have additional expenses, such as transportation or repair costs. Effective categorization of expenses allows a food pantry to optimize its resources and maximize its impact on the community. Understanding these categories and allocating resources appropriately is essential in fulfilling the pantry’s mission to assist those in need.

Monitoring and Adjusting the Food Pantry Budget

In today’s economy, managing a food pantry budget can be a challenging task. As demand for services increases, it’s important to ensure that the funds are allocated properly, and expenses are controlled. By monitoring and adjusting the food pantry budget regularly, it’s possible to make sure that every dollar is spent efficiently and effectively. This requires constant communication with stakeholders, analyzing trends, and making appropriate adjustments as needed.

With the right approach, it’s possible to maximize the impact of the food pantry, providing vital services to those in need while staying within budget. The key is to be vigilant and proactive, staying ahead of the curve and minimizing waste wherever possible. With dedication and careful attention, the food pantry budget can be a powerful tool for delivering essential resources to those who need them most.

How to Create a Food Pantry Budget Template

When it comes to running a food pantry, budgeting is essential. By creating a budget, you can ensure that you have enough money to purchase the food and supplies you need to keep your pantry running smoothly.

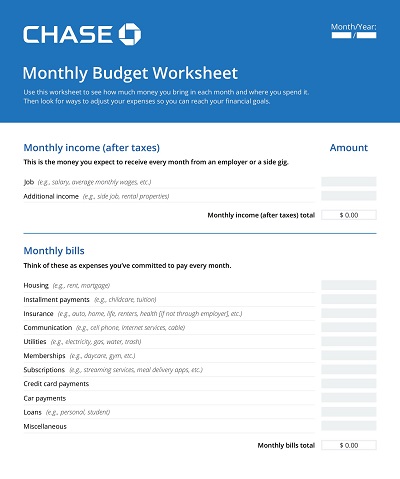

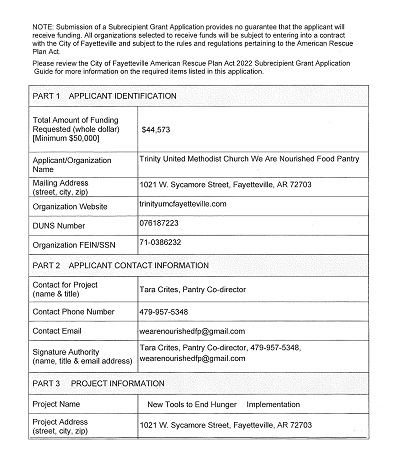

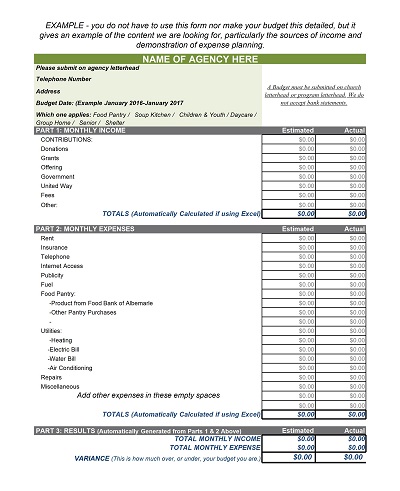

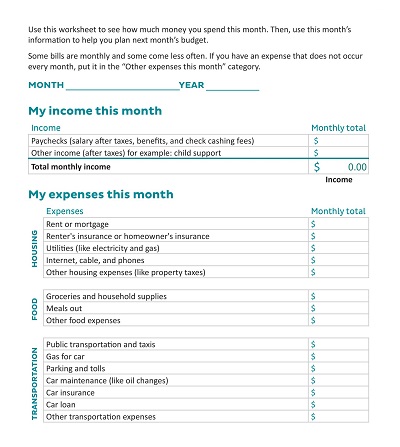

Determine your income sources

The first step in creating a food pantry budget template is to determine your income sources. Where does the money for your food pantry come from? Is it from donations, grants, or fundraising efforts? Once you have a clear understanding of how much money you have coming in, you can move on to the next step.

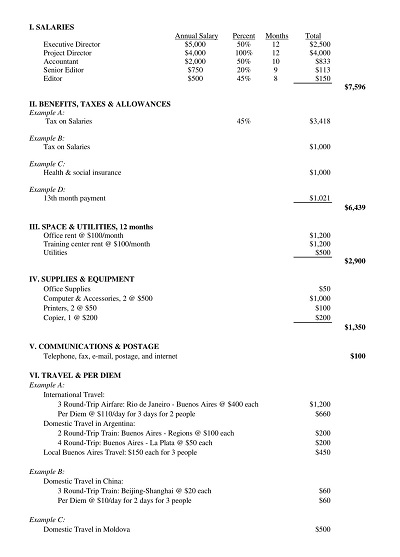

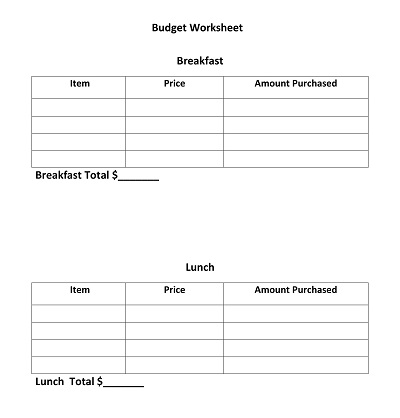

List your expenses

Next, you need to list your expenses. This includes everything from rent and utilities to the cost of purchasing food. Be sure to include any other expenses like staff salaries, office supplies, and transportation costs. Make sure you have a line item for every expense, no matter how small.

Assign expense categories

Once you have listed all of your expenses, it’s time to assign categories to each expense. This will make it easier to track your spending in the future. For example, you might have categories like “food purchase,” “rent,” “utilities,” and “salary.”

Determine a monthly or yearly budget

Now it’s time to determine how much money you should allocate to each expense category. To do this, you will need to create a monthly or yearly budget. Make sure that you have allocated enough money for each category, so you don’t come up short later on.

Use software or a spreadsheet to track expenses

Finally, it’s time to track your spending. You can do this manually with a spreadsheet or use software, like QuickBooks or Excel, to do it for you. Be sure to keep accurate records of all your expenditures, so you always have an up-to-date understanding of your financial situation.