05+ Free Bare Bones Budget Worksheet Templates – PDF

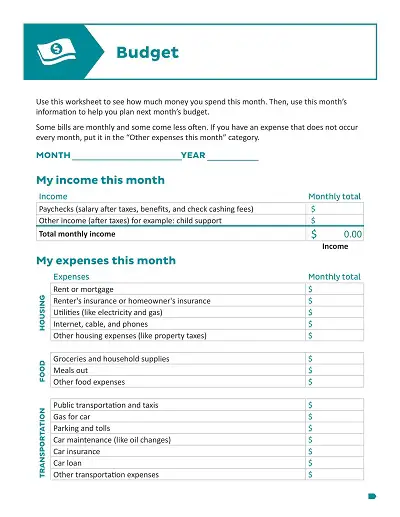

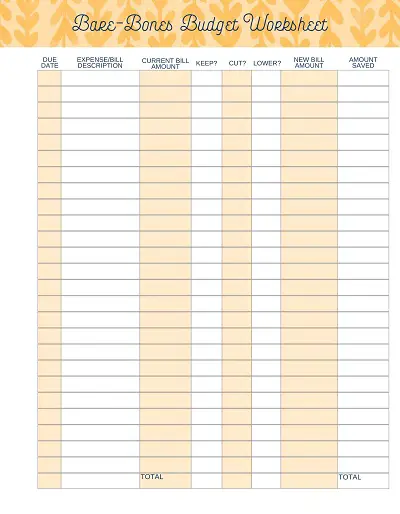

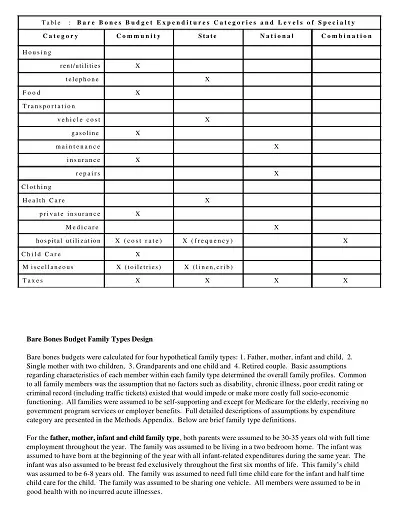

A bare-bones budget worksheet template is an invaluable tool for those who want to get better control of their finances. It is a straightforward spreadsheet that allows one to track monthly income and expenses from all sources, providing them with an at-a-glance view of their total assets and liabilities. With this type of template, users can also forecast future spending and build a more organized financial strategy without needing any special skills or software, they simply need to fill in the projected dates and items on the provided skeleton form.

Table of Contents

The information collected can then be used in estimating a realistic financial plan that reflects both current and future income and expenditure patterns. Highlighting the importance of having good money management skills, the bare bones budget worksheet template remains an easy-to-use solution for anyone wishing to take charge of their financial health.

Download Free Bare Bones Budget Worksheet Templates

Benefits of Using a Bare Bones Budget Worksheet

A bare-bones budget worksheet is the first step to achieving financial stability. It forces consumers to face the realities of their current income and expenses and allows them to see clearly where cuts can be made. This tool helps consumers see potential savings in areas they may have taken for granted before, such as recurring fees from subscriptions or impulse purchases from frequent shopping trips.

Using a bare-bones budget also encourages people to prioritize their spending, ensuring that money is allocated first to the needs that must be met such as rent, food, and utilities. Not only does this work towards increasing overall financial stability, but it also brings peace of mind knowing that no important bills are going unpaid.

Long-Term Financial Planning with Bare Bones Budgeting

Long-term financial planning can be difficult, but through the use of a bare-bones budget, it can be made much easier. Bare Bones budgeting focuses on essential spending and cuts out all unnecessary splurge costs. By rethinking purchases and deciding what is essential for daily life and possible emergencies, making long-term financial decisions becomes much more straightforward.

It empowers people to make proactive choices regarding their future well-being and take control of their finances. Not only that, taking the time to create a budget allows individuals to build a positive track record with credit institutions so they may be able to borrow money if necessary in the future when they encounter larger financial decisions.

How to Create a Bare Bones Budget Worksheet Template

Budgeting is something that everyone needs to do, regardless of how much money they make. However, creating a budget can be a daunting task, especially if you’re not sure where to start. That’s where a bare-bones budget worksheet template comes in.

A bare-bones budget worksheet template is a simple, easy-to-use tool that can help you get a better handle on your finances. Here is how to create a bare-bones budget worksheet template.

Determine Your Income

The first step in creating a bare-bones budget worksheet template is to determine your income. This includes any money that you bring in, such as your salary or wages, as well as any other sources of income, such as rental income or child support.

List Your Expenses

Next, you’ll need to list all of your expenses. This includes everything from your rent or mortgage payment to your utility bills to your groceries. Make sure to include all of your regular expenses, as well as any occasional or one-time expenses that you may have.

Categorize Your Expenses

Once you’ve listed all of your expenses, it’s time to categorize them. This will help you see where your money is going and identify areas where you may be overspending. Some common expense categories include housing, transportation, food, entertainment, and debt.

Calculate Your Income and Expenses

Now that you have all of your income and expenses listed and categorized, it’s time to calculate them. Subtract your total expenses from your total income. If you have a positive number, great. That means you’re spending less than you’re earning. If you have a negative number, you’ll need to make some adjustments to your spending in order to balance your budget.

Make Adjustments and Plan for the Future

Finally, it’s time to make any necessary adjustments to your budget and plan for the future. If you’re spending more than you’re earning, you’ll need to find ways to cut back on your expenses. This may require making some sacrifices, such as eating out less often or finding ways to reduce your monthly bills. On the other hand, if you’re spending less than you’re earning, you may want to consider saving or investing some of your extra money.