26+ Free Department Budget Spreadsheet Templates (PDF)

When it comes to managing departmental budgets, a department budget spreadsheet template can be a lifesaver. This tool provides a structure for organizing financial information specific to your department, allowing you to track expenses and revenue more efficiently. With the help of a department budget spreadsheet template, you can quickly identify where you’re overspending or where you have room to allocate additional resources.

Table of Contents

This makes it easier to adjust your spending and stay in line with your department’s financial goals. By keeping your department’s finances organized in one place, you can also minimize errors and save time when it comes to reporting and forecasting.

Download Free Department Budget Spreadsheet Templates

Importance Of Department Budgeting

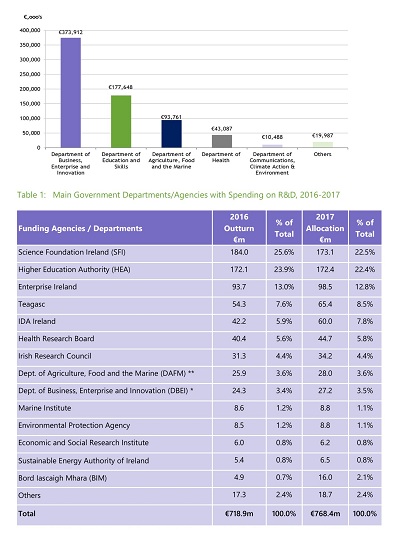

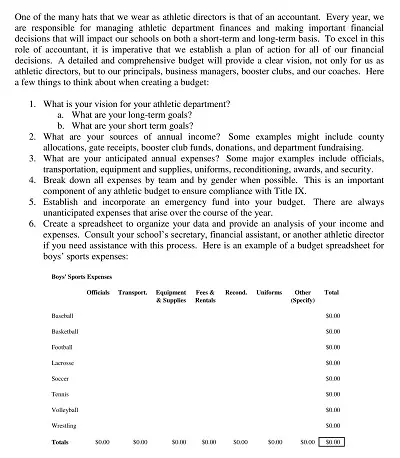

Department budgeting is a crucial aspect of any organization, as it allows for better financial planning and resource allocation. It’s no secret that businesses operate on tight budgets, and it can be challenging to prioritize and make informed decisions about expenditures without a clear understanding of the current financial situation. Department budgeting ensures that each department has a clear understanding of its financial constraints and can plan accordingly to achieve business goals.

It also helps identify areas of financial waste and potential cost-saving measures. Over time, department budgeting can lead to more cost-effective operations, increased profits, and a more successful business overall. So if you want to ensure that your organization is operating at maximum efficiency and profitability, department budgeting is undoubtedly worth the effort.

Key Elements Of A Department Budget

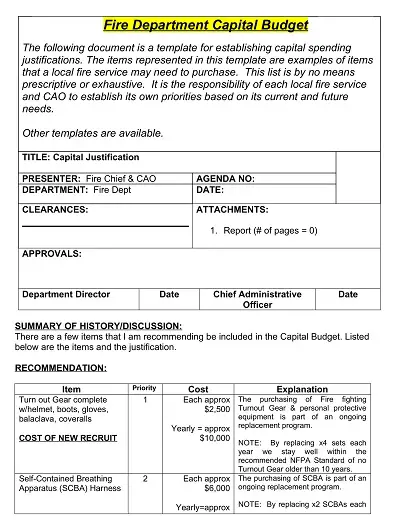

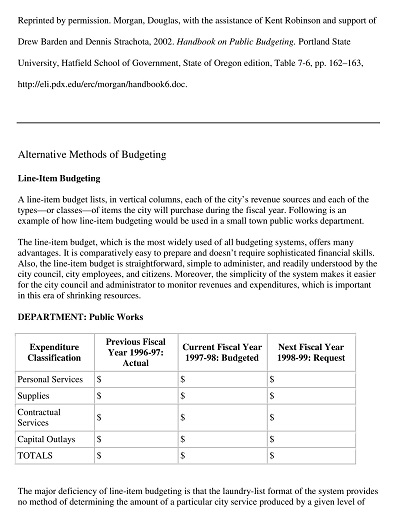

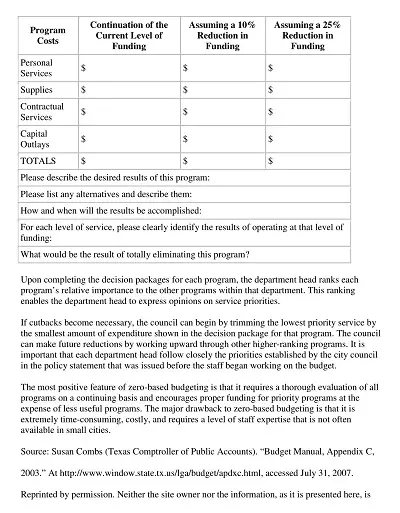

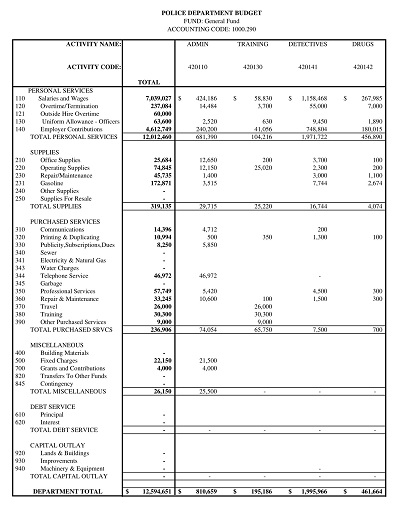

Creating a department budget can be a daunting task, but understanding the key elements can make the process smoother. A department budget is a financial blueprint that outlines expenses, revenues, and expected goals for a specific period. One key element is accurately estimating expenses, which can include salaries, supplies, and equipment.

Another important element is projecting revenues, which can be based on historical data, market trends, or sales goals. It’s also crucial to consider potential risks and have contingency plans in place. By paying attention to these key elements, department heads can ensure their budgets are realistic, achievable, and aligned with their organization’s overall goals.

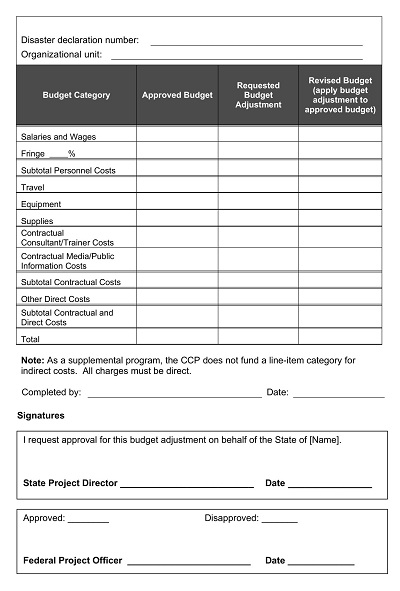

Analyzing Department Budget Variance

At the heart of any successful business lies the ability to understand budget variance. After all, even the most carefully crafted budget can be rendered ineffective if unexpected changes or overspending occurs. That’s why analyzing each department’s budget variance is crucial to the overall health of the organization.

The key is to identify patterns and trends in each department’s spending habits so that adjustments can be made in real-time to avoid any future surprises. By keeping a watchful eye on the numbers and addressing any concerns promptly, companies can stay ahead of the game and stay firmly on a course toward meeting their financial goals.

Step-by-Step Guide to Creating a Department Budget Spreadsheet Template

Creating a department budget spreadsheet template can be challenging, especially if you are new to the task. With an organized structure, though, it can become much easier to plan and manage your department’s resources. This step-by-step guide will explain how to create the perfect budget spreadsheet template for your needs.

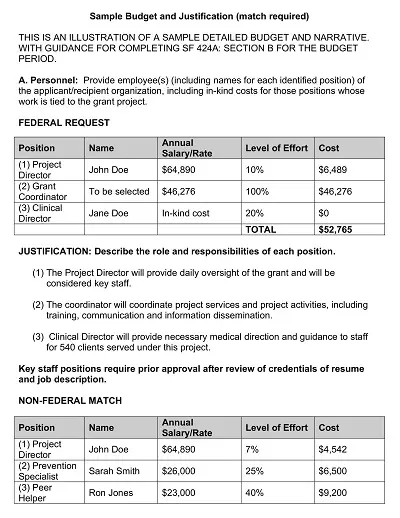

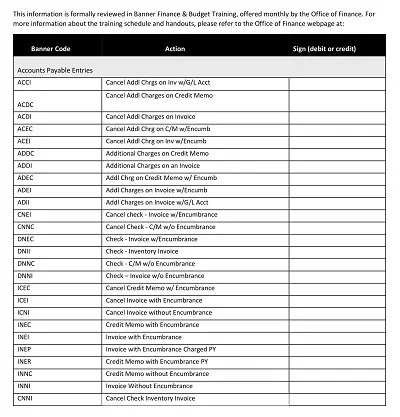

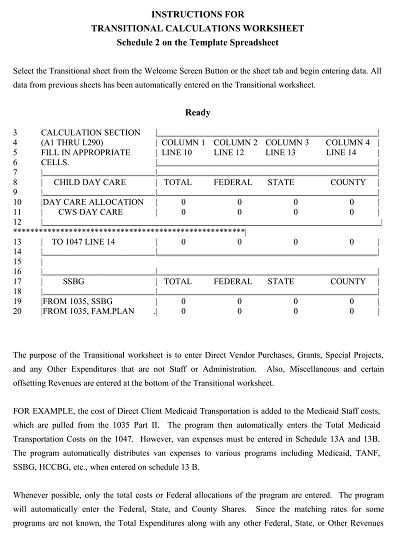

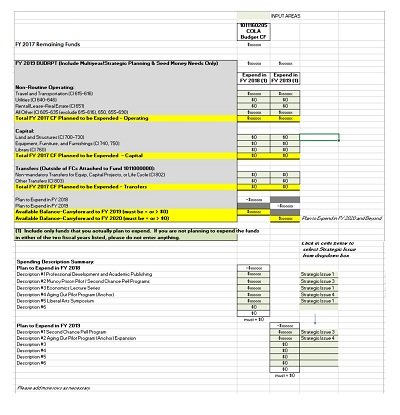

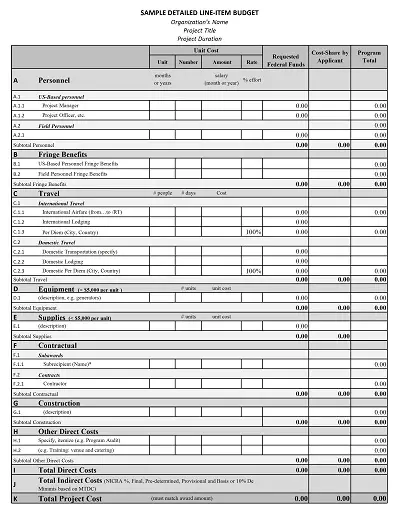

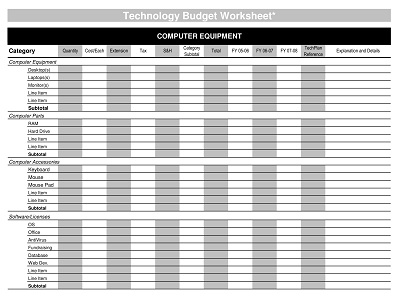

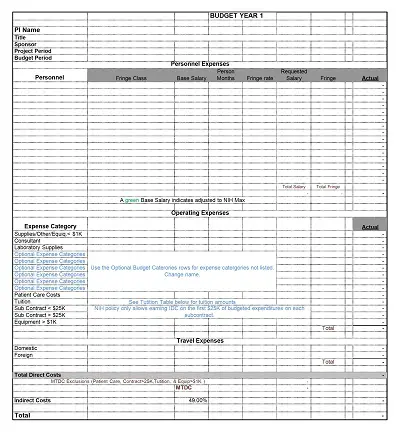

First off, you need to decide what type of software platform you will use for your budget spreadsheet template. This could be anything from Excel or Google Sheets to specialized accounting software like QuickBooks or Quicken. Once you have chosen the right software program for your needs, you should begin by creating the basic layout of your budget spreadsheet template. This typically includes sections such as income, expenses, assets, liabilities, and any other relevant categories that may apply. Be sure to include labels so that everything is clearly understood within the document.

The next step is adding all of the necessary information into the spreadsheet template. In this section, you will want to list out all of your income sources such as salaries, investments, and grant funding. You should also include details about any expected expenses such as salaries, rent costs, and other overhead expenditures associated with running your department throughout the year. Finally, make sure you include sections for tracking liabilities such as loans or debts accrued over time. Doing this will help keep track of what is owed and when payments are due each month or quarter.

After completing this initial setup phase for your department budget spreadsheet template, you must update it regularly with accurate information about spending and income sources coming into and going out of your organization. This process involves manually entering data from receipts or invoices into specific cells to accurately record any changes in cash flow or total assets available at any given time throughout the year. Keeping up with these updates helps ensure accuracy when preparing final reports at year-end or when making decisions related to future financial planning efforts within your organization’s budgeting process.