10+ Free Commercial Property Budget Templates (MS Excel, PDF)

Managing the finances of a commercial property is no easy feat. From rental income to managing expenses, it can be a daunting task to keep track of all the moving parts. That’s where a commercial property budget template can come in handy. With a well-designed budget, landlords and property managers can stay on top of income, expenses, and upcoming financial obligations.

Table of Contents

By utilizing a template designed specifically for commercial properties, owners and managers can customize it to fit their individual needs while maintaining accuracy and consistency in financial reporting. Imagine the peace of mind that comes with knowing exactly where your money is going and having a clear picture of future profitability. With a budget template, staying financially organized has never been easier.

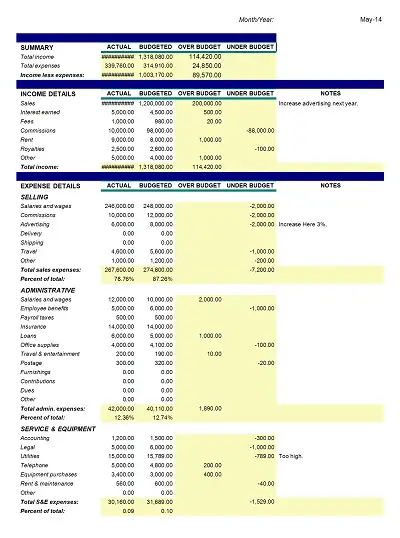

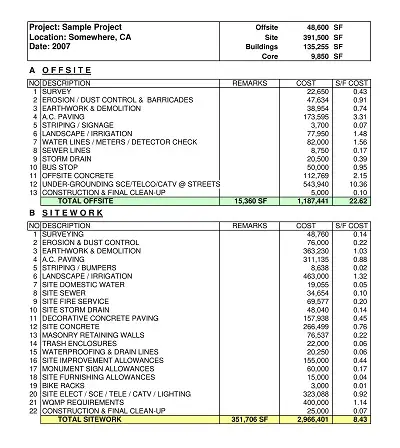

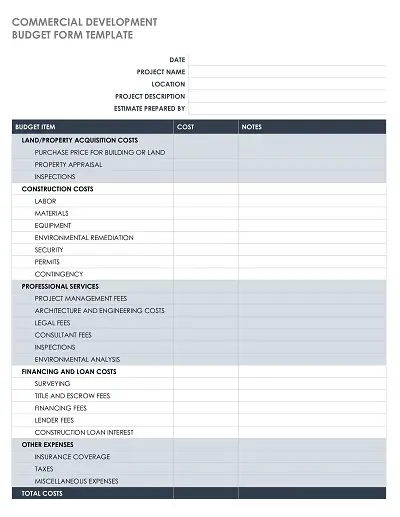

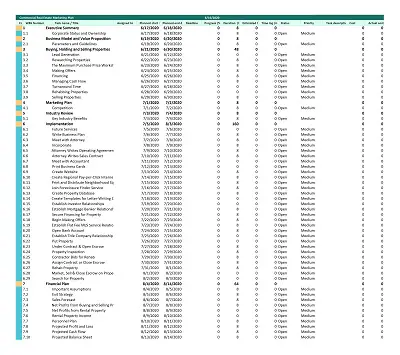

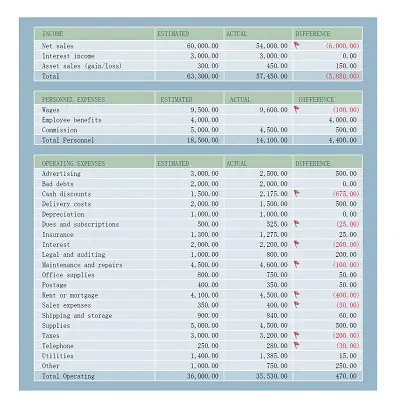

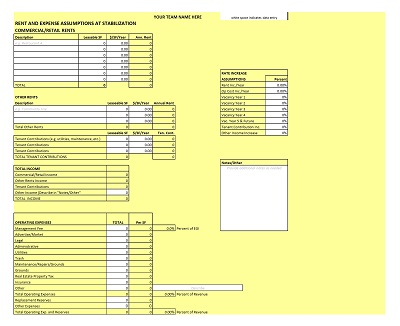

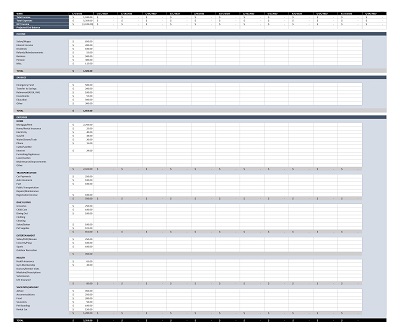

Download Free Commercial Property Budget Templates

Key Components of a Commercial Property Budget

When it comes to commercial property, creating an effective budget is crucial for keeping your financials in check. Several key components should always be included to accurately predict and manage your expenses. First and foremost, you must consider your operating expenses, such as utilities and maintenance costs.

It’s also important to factor in any potential capital expenditures, such as upgrades or repairs to the property. Another critical component is calculating your potential revenue, including lease income and any additional income streams. By taking a comprehensive approach to your budget, you can ensure that your commercial property is financially sustainable for the long haul.

Importance of a Commercial Property Budget

Running a commercial property can be a profitable business, but it also requires careful financial management. This is where having a budget comes into play. A commercial property budget is an essential tool for property owners and managers to ensure that they allocate resources efficiently and effectively.

In addition to stemming overspending, a budget can also help identify potential areas of growth, negotiate vendor contracts, and avoid unexpected expenditures. A well-planned budget can also provide lenders and investors with greater confidence in the property’s financial stability. Ultimately, a commercial property budget gives owners and managers the control they need to maximize their return on investment and keep their property operating smoothly.

How to Create a Commercial Property Budget Template

Budgeting is a crucial part of any business, and this is especially true for commercial property owners. Creating a budget template will help you to track expenses and make informed financial decisions.

Determine the budget period

The first step in creating a commercial property budget template is to determine the budget period. This could be monthly, quarterly, or annually. Choose a budget period that aligns with your financial goals and works best for your business needs.

List all income sources

Next, list down all income sources, such as rent, storage, parking, and any other income streams. Be sure to include any potential income that may arise during the budget period.

Identify all expenses

Identify all expenses, such as property taxes, maintenance, repairs, utilities, insurance, advertising, and employee salaries. This will help you to identify your profit margin and minimize expenses where possible.

Determine fixed and variable expenses

Determine what expenses are fixed and what expenses vary each month. Fixed expenses like insurance and property taxes usually have a set rate, while variable expenses like maintenance and repairs can vary based on the property’s condition.

Build the spreadsheet

Once you’ve identified all income and expenses, it’s time to build the budget template using a spreadsheet. You can use software, such as Microsoft Excel, to create a standardized template. You can also customize it to align with your business’s unique needs.