17+ Free Personal Net Worth Statement Templates

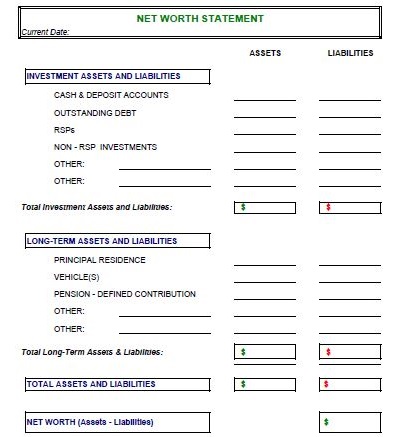

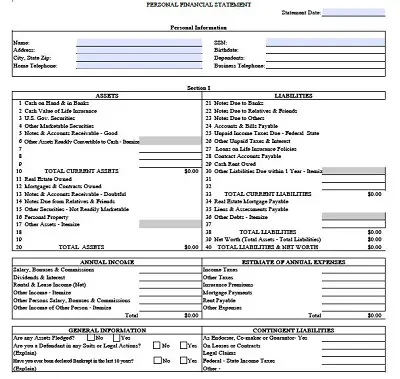

A personal net worth statement or sheet is simply a personal financial balance sheet. It shows where someone stands financially in his/her life. A personal net worth statement or personal; financial statement is simply someone’s personal balance sheet. It consists of all assets what someone owns and subtract liabilities what someone owns, and that is his net worth.

Table of Contents

If you lead a prosperous life you need to have control over your finances..you have a lot of assets, even more liabilities to clear. When We prepare a net worth statement, we find a clear picture of our financial status. The worth net statement is really required. Suppose we are planning to apply for a loan or even planning b to make some investment. The financial institutes can ask you about a net worth statement before considering your application. If you have a financial record for two board heads, that is assets and liabilities. You can calculate quickly and easily the net worth of an individual.

It is also important to calculate the net worth every year.BY calculating it, you can improve what you measure and track. Using a balance sheet template and calculating net worth statements at the end of the year gives the assurance of improving your financial pictures.

Benefits Of Net Worth Statement

A net worth statement PDF has some benefits.that are given below.

A net worth statement gives you a clear picture of your financial well being so that you can make well-informed decisions

- By calculating your personal net worth, you can know your exact starting point and how far you need to reach your long term financial goals.

- By growing and stating your personal net with not only you can keep a positive finical course but also help you qualify for loans and more credit terms

- By setting financial goals and identifying the problem areas, you can be well informed about your current net worth.

How To Increase Your Net Worth ?

You can increase net worth statements for an individual by reducing your debt and increasing your assets. Assets and liabilities spreadsheet temple are also available for your requirement; you can easily download it for a personal net worth statement.

Dollar for dollar reduces debt and increasing assets and assets has an equal impact on your net worth, making both equally important.

Reducing liabilities is limited since you only go to zero. In contrast, increasing assets is unlimited as well as there is no upper boundary to how much to grow the asset side of the equation. So, it is valuable to pay attention to both but focus on the asset solemn for maximum wealth growth.

Creation Of A Net Worth Statement

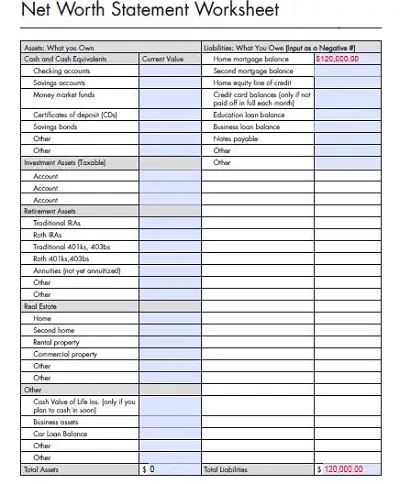

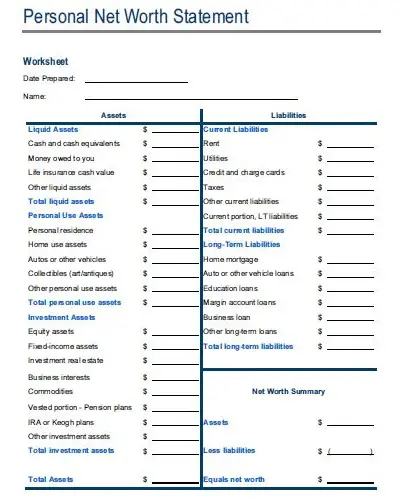

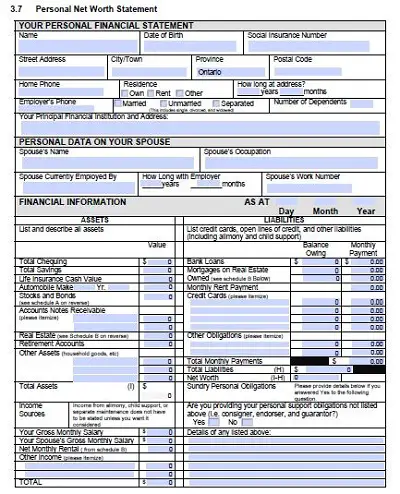

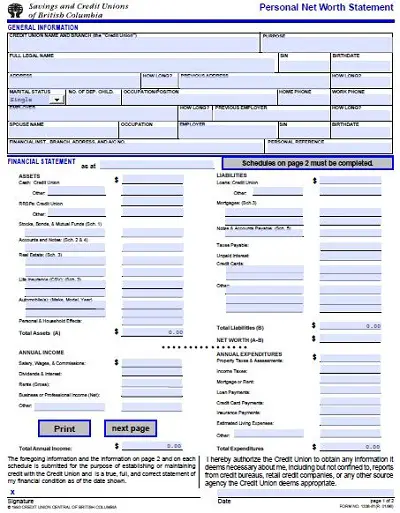

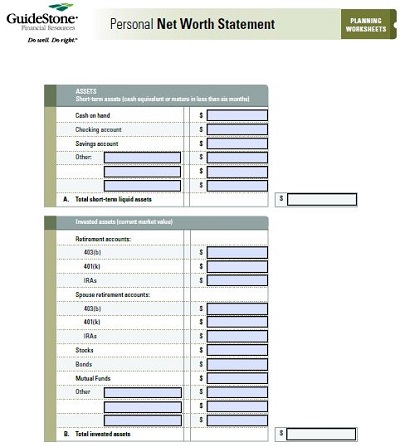

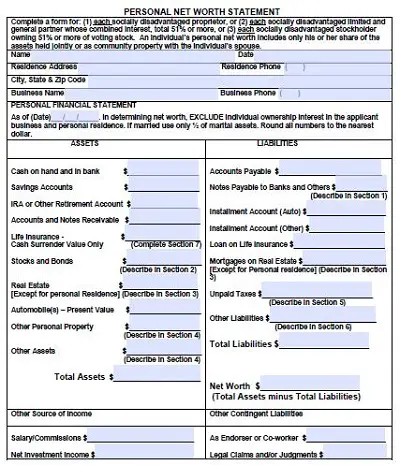

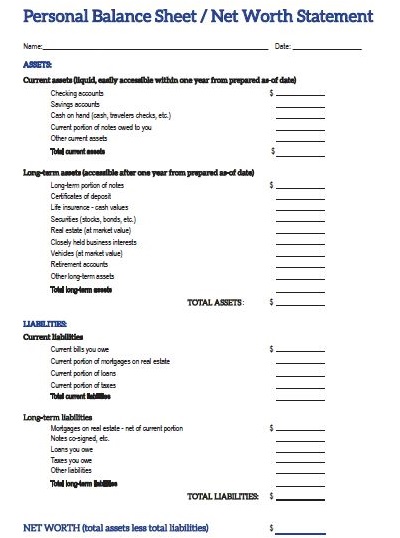

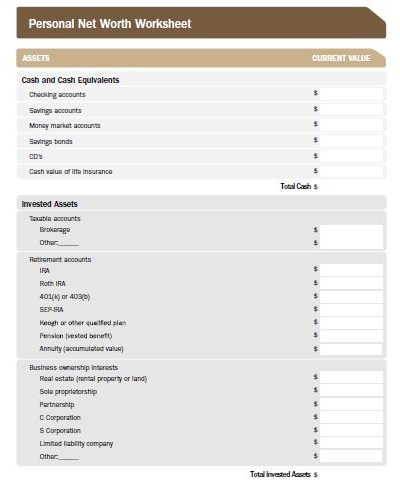

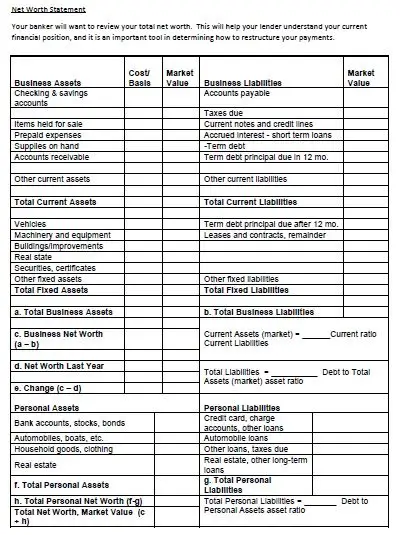

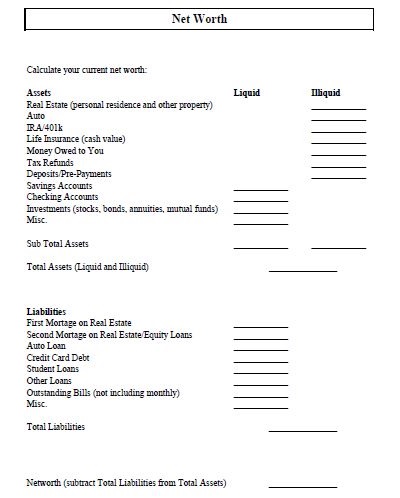

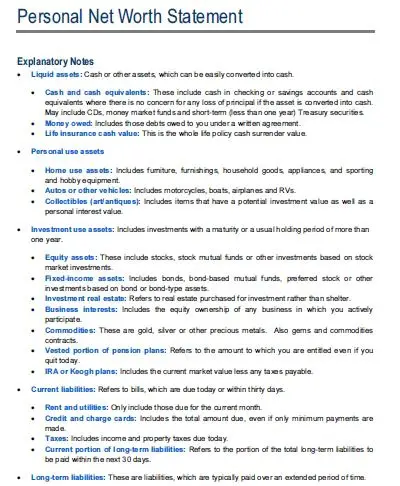

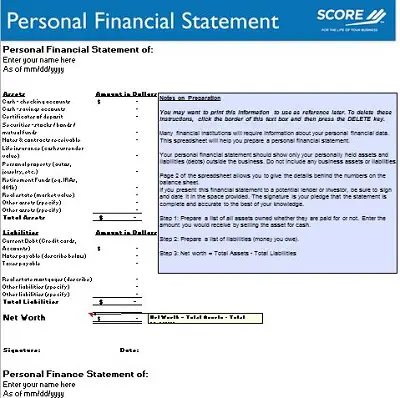

A personal financial statement provides a realistic listing of the assets. We own and the debts we owe. The statement should be used to record the details of personal assets and liabilities. How to write a personal net worth statement ?. The liabilities details should not be added to the net worth statement. The amount entered for calculation the assets valuation should include the exact value that you have earned on selling the asset in the market. You can record the name of the individual whose statement you are preparing and the exact date when it was prepared. A country-specific setting allows us to select a currency type from the drop-down menu. The net worth statement sheet has two broad categories of financial information as follows.

- Assets what you own?

- Liabilities what you owe?

- Assets

- Complete details of cash, bank accounts and savings.accounts, money market funds, and the cash value of market funds and cash values of life insurance.

- Liabilities.

- Current debts: stores records of debts like a medical, credit card, bank taxes, legal, household.

- Mortgage:: A details of any kind mortgage debts like homelands,

- Loans: values of debts like bank loan, educational loan, automobile loan, life insurance, personal loan etc

Above mentioned eh categories is calculated separately.in the statement A net worth calculator is used for this purpose. It helps to analyze the category which needs more financial revamping. The net total assets are deployed below the assets table, and the net liabilities are displayed under the liabilities table. Whenever any institute asks for your net worth financial statement, then you print it and sign it under before dispatching the net worth statement to the concerned department.

Improvement In Finance With Help Of Net Worth

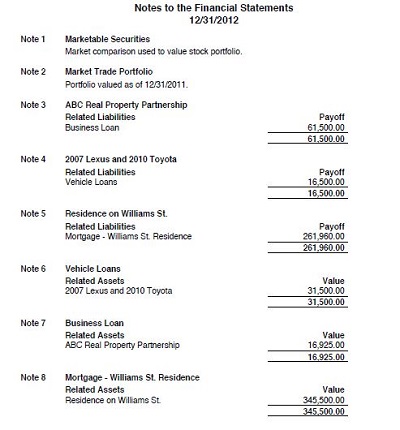

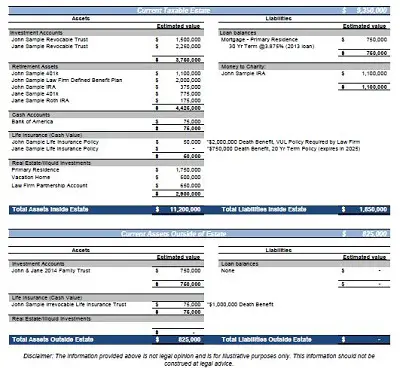

Your personal net worth statement a personal financial statement is a mirror where you are at financially. It does not show about cash flow or our monthly income with expenses. It also provides financial insight relating to how you are accomplishing your long term financial goals. If you determine your net worth, then you can move easily to see what items are holding you back. In the mentioned example, it appears that home has decreased in value, and the market value is less than what homeowner owns on loan..so, the situation will be remedied by recovering a housing market.

The student loans are a big liability for this person, perhaps examining a monthly budget more closely might yield areas to cut back in and the free up funds to devote to extra mortgage payments, student loan payment or additional investments that could offset debts in a total net worth calculation.

A glance at the net worth statement for an individual also shows the less value of the cars is paid off, and if it is sold, it could actually eliminate what remains of the credit card debt. All these observations may help you when you formulate a financial plan to improve your finances and strive for positive net worth cement.So, calculating and tracking net worth statements is an important item in your financial toolbox. A net worth format is available here..It checks the ups with budget analysis and tracking software. It also has financial plans that incorporate the short terms and long terms of financial goals. To accomplish these goals net worth statement checkup that you are on a track to meet the pursuing goals.